30 de maio de 2020

First, a review of last week’s events:

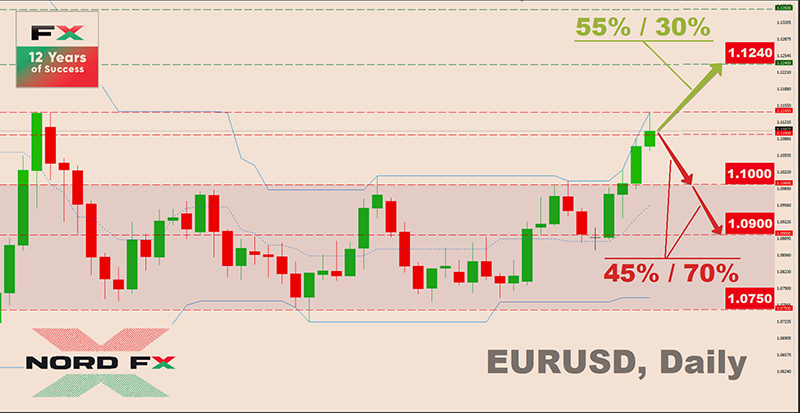

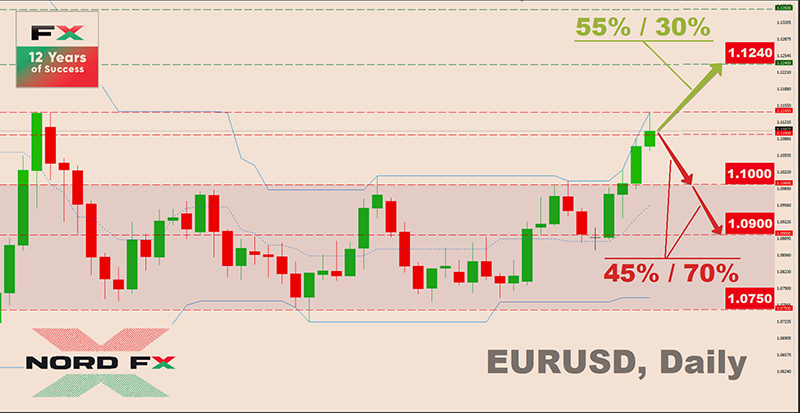

- EUR/USD. The European currency has been growing all week, even despite the rather weak statistics on the Euro zone economy. The pair was helped to break through the upper limit of the 1.0750-1.1000 corridor and rise to the height of 1.1145 by the news on the recovery measures in the EU, including the EU's plans to conduct direct emission and seriously expand its budget. The Swiss Bank, which buys EUR in exchange for its national currency, also provided support to the euro.

By the end of the week, the hot activity of the bulls was somewhat cooled by the Donald Trump statement on new US measures against China. Typically, the euro falls each time, as soon as another exacerbation begins between Washington and Beijing, as this is an obvious signal for new economic problems in Europe. But, according to a number of analysts, the quotes of the European currency have already fallen so low that titanic efforts of the bears are needed for its further serious movement to the South. As a result, the pair sank only slightly below the center of the four-day rising channel and finished near the level of 1.1100;

- GBP/USD. Last week, the dollar retreated not only on the onslaught of the euro, but also in pairs with the pound and yen. The British currency strengthened its position even despite the "dovish" statements of a member of the Monetary Policy Committee of the Bank of England, Michael Saunders. Such a development of events was expected by 30% of analysts, according to whom the pair should have returned to the central zone of the channel 1.2165-1.2650. The most accurate forecast was given by the graphical analysis on D1, which traced the rise of the pair to the height of 1.2350. It was in this zone that the pound remained most of the trading session, there it set its final chord;

- USD/JPY. Most (65%) experts expected the return of the USD/JPY pair to the May 06 low in the 106.00 zone. And by the beginning of Friday, May 29, it did go down, but it only reached 107.07. Thus, the weekly volatility of the pair was less than 90 points. And this despite the fact that two months ago it easily flew ten times more in five days.

Yes, the situation with the COVID-19 pandemic is gradually returning to normal. But along with it, the difference in regulatory conditions between major currencies is gradually disappearing. Just look at the key G3 interest rates. Therefore, the volatility of the Japanese currency against the US is no longer the same as in March.

If we talk about the results of the week, the pair again found itself within the extremely narrow side corridor of 107.30-108.00, putting the final point at 107.80;

- cryptocurrencies. Let's start with the scariest news. - The days of bitcoin are numbered, said Twitter user MasterChangz, who is trying to hack crypto wallets by picking up private keys. According to him, the code of the main digital coin will be cracked by him within 5 years. “Now I sort through 600 million keys per second, but every two years the selection speed increases by about 10 times due to technological updates in computer technology,” wrote MasterChangz.

But it turned out that everything is not so scary, and Bitcoin will still live for some time. “Technically, picking up a private key is possible. However, it will take a lot of time,” says Bitcoin Core developer Luke Dashzhr. According to his calculations, it will take about 38593493520073954175290747912192 years to crack a simple old Bitcoin wallet using middle-class video cards.

Danny Dikroeger, developer of the Cash App, also expressed doubt about the success of the plan. He believes that even if MasterChangz can increase the computing power of technology a billion times and pick up keys for 100 years, the chance of coming across a suitable key for hacking the wallet will be 0.00000000000000000000000000000000000001%.

And now, having calmed down, we turn to the forecast that the experts gave for the previous week. Their votes were more or less evenly distributed in the $8,400 to $10,000 range. The same thing happened in reality, only in a slightly narrower range. At first, bitcoin quotes went down, reaching the local bottom at $8,600 on May 25. This was followed by a reversal of the trend, and the BTC/USD pair overcame the resistance of $9,600 on Friday 29 May. As some analysts believe, such growth was facilitated by a large whale transaction: according to WhaleAlert, 11,660 BTC (worth more than $111 million) were transferred between two unknown wallets.

On Friday evening, May 29, Bitcoin quotes are in the $9,400 zone. The total capitalization of the crypto market increased in seven days from $246 billion to $265 billion (+7.7%), and the Crypto Fear & Greed Index grew by 6 points - from 42 to 48.

And some more statistics. According to the payment company Revolut, after a fall in trading volumes in March by 52%, the number of customers trading cryptocurrencies increased by 68% in April. By the end of the month, the amount of digital assets purchased by each of them increased by an average of 57%. During these months, 51% of all transactions were in Bitcoin (BTC/USD), Ripple (XRP/USD) - 20%, and Ethereum (ETH/USD) - another 14%. Litecoin (LTC/USD) is in fourth place with 8% of all transactions.

The demand for the ripple is somewhat surprising because its price has decreased by almost 60 per cent over the past 12 months while bitcoin, despite all the twists and turns, has remained at zero, ending up, as at the end of May 2019, in the $9,000 zone. And this despite the fact that the XRP emission reached only 30% of the maximum volume of coins, in contrast to 87.5% for BTC. Although, perhaps, active ripple purchases are due to the fact that investors consider this altcoin to be underestimated and expect its rapid explosive growth.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. It is clear that at the end of the past week from 90% to 100% of indicators on H4 and D1 are looking up. And only 10% of the oscillators give signals that the pair is overbought. But almost half of analysts have doubts about the possibility of further growth of the euro. Market risk appetites are dying away, and if the US goes on the offensive in the Chinese direction, the EUR/USD pair may again turn south. It should be noted that the strengthening of the dollar in the week term is expected by only 45% of experts, but when moving to the monthly timeframe their number increases to 70%. The immediate task of the bears is the return of the pair within the channel 1.0750-1.1000, support - 1.1065, 1.1000 and the central line of the channel 1.0900. The resistances are located at levels 1.1145 and 1.1240.

Among the events to pay attention to in the coming week are the publication of data on business activity in the US (ISM) – in the manufacturing sector on June 01 and in the services sector - on June 03, data from the German and EU labor markets on Wednesday June 03, the ECB meeting and press conference on Thursday June 04, and data from the US labor market (including NFP) – traditionally on the first Friday of the month, June 05;

- GBP/USD. If there is a certain fuss in the indicator readings characterizing the lateral movement of the pair, analysts' preferences look more certain. 25% of them support the side trend, another 25% are for further strengthening of the pound, and 50% are for its fall. The latter are supported by graphical analysis on D1. In addition to the problems in the economy, the uncertainty over Brexit continues to weigh on the British currency. So, speaking in the European Parliament, European Commissioner Phil Hogan said that the UK may have decided that the conditions for a deal with the EU are now absent. Although he did not rule out that the situation could become a little clearer after the resumption of negotiations in the coming week.

At the moment, support levels are 1.2245, 1.2165 and 1.2075, resistance levels are 1.2365, 1.2465 and 1.2650;

- USD/JPY. As mentioned above, the market risk appetite has once again greatly subsided. And if US President Trump goes to further aggravate the situation with China, the dollar may start to rise sharply again. But not in relation to the yen. Investor demand for safe havens will either improve the position of the Japanese currency against the US (especially if the yield of protective bonds slips towards new lows) or keep it at the same level, as it happens the last two months.

The results of the analysts' survey and the indicators' readings look similar as well: "either, or, or..." A third looks north, a third south, and a third east. Support/resistance levels are the same: from bottom of current quotes - 107.30, 106.80 and 106.20, from top - 108.00, 108.50 and 109.25;

- cryptocurrencies. At the time of the forecast, bitcoin is consolidating in the area of $9,400. And only 30% of analysts expect that it will be able not only to break through the key level of $ 10,000 in the coming days, but also to gain a foothold above it. The harbinger of this, they believe, is the increased interest in BTC futures contracts, which pushes the value of the coin up. The remaining 70% believe that the BTC/USD pair will continue to move in the range of $8,600-9,600, although they do not rule out breakout attempts in one direction or the other.

As for the predictions of crypto gurus, as usual, everyone is waiting for the start of a new leap to unseen heights. - Alexis Ohanian, creator of the large crypto website Reddit and the husband of famous tennis player Serena Williams, said that the current situation in the digital asset market resembles a full-fledged crypto spring. He said not only Bitcoin's relatively stable value plays an important role, but also its growth after the failure in early March. So far, the growth trend has been observed with a certain frequency, but an important barrier in the form of bitcoin halving has been overcome. We need to survive its minor consequences and continue to develop the industry”, — said the head of Reddit.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.