EUR/USD: Rather Boring Week

- The past week was, boring, so to say. The macro statistics released from August 30 to September 2, although versatile, turned out to be quite close to market expectations. For example, the harmonized consumer price index in Germany, was 8.8%, with the forecast of 8.8%. The consumer price index in the Eurozone amounted to 9.1% instead of the expected 9.0%. The index of business activity in the US manufacturing sector (PMI) did not change at all over the month and amounted to 52.8 (forecast 52.0), and the number of new jobs created outside the American agricultural sector (NFP) did not go far from the expected either, 315K against 300K. As a result, EUR/USD was moving along the parity line of 1.0000 all five days, fluctuating in the range of 0.9910-1.0078, and completed the five-day period at the level of 0.9955.

Market participants are likely to be much more active next week. The key day will certainly be Thursday September 08, when the ECB will decide on the deposit rate and make a statement and comments on its monetary policy. Inflation in the Eurozone rose even more in August: from 8.9% to 9.1%. Therefore, many experts, such as the strategists of the international financial group Nordea, believe that the European regulator will raise the rate by 75 basis points at once.

“Considering that the rate increase by 75 b.p. is not fully priced in financial markets and that the tone of the press conference is likely to be hawkish,” Nordea economists write, “we expect the first reaction from markets to be higher yields, wider bond spreads and a stronger euro.”

If we talk about the average forecast, it looks as follows at the time of writing the review, on the evening of Friday, September 02. 50% of experts vote for the fact that EUR/USDwill move south in the near future, 35% vote for its growth, the remaining 15% are waiting for the side trend to continue. The readings of the indicators on D1 give much more definite signals. Both among trend indicators and among oscillators, all 100% side with the bears. However, 10% among the latter give signals that the pair is oversold.

The nearest bearish target for EUR/USD is the 0.9900-0.9910 zone. Note that the 0.9900-0.9930 area is also a strong 2002 support/resistance zone. Apart from the parity level of 1.0000, if the euro strengthens, the first priority for the bulls will be to rise above the resistance of 1.0030. After that, it will be necessary to overcome the level of 1.0080 and consolidate in the zone of 1.0100-1.0280, the next target area is 1.0370-1.0470.

Among the upcoming week's events, apart from the ECB meeting, we can single out the publication of data on retail sales in the Eurozone on Monday, September 05. Monday is a holiday in the United States, the country celebrates Labor Day. We are waiting for data on business activity (ISM) in the US services sector on Tuesday, September 06, and GDP indicators in Germany and the Eurozone will be published on Wednesday. Fed Chairman Jerome Powell is scheduled to speak and data on unemployment in the United States will be published on the same day.

GBP/USD: On the Way to a 37-Year Low

- We titled our review of the GBP/USD pair "Gloomy Forecasts for the Pound Continue to Come True" two weeks ago. The past headline sounded like "Very Terrible Long-Term Outlook" We can not say anything cheerful this week either: the pound is still one of the weakest G10 currencies, which is affected by the worsening prospects for the UK economy.

The British Chamber of Commerce (BCC) estimates that the UK is already in the midst of a recession and inflation will hit 14% this year. And according to Goldman Sachs, it could reach 22% by the end of 2023. According to the Financial Times, the number of British households living in fuel poverty will more than double in January to reach 12 million people. And the new prime minister will have to take urgent action to avoid an economic disaster. Just what action? It seems that no one knows yet.

In such a situation, the anxiety of market participants about the candidacy of the next prime minister, whose name will be announced on Monday, September 05, is quite understandable. Recall that the current Prime Minister Boris Johnson has resigned after a sex scandal involving one of his cabinet members.

Against this gloomy background, the pound has been falling since August 01. Having broken through support at 1.1500, it set two-year lows (1.1495) last week. As for the final chord of the five-day period, it sounded a little higher, at around 1.1510. Most experts (55%) believe that GBP/USD will continue to fall in the coming weeks. And it will not stop even if the Bank of England raises interest rates by 75 bp on September 15. 30% hope for a correction and 15% have taken a neutral position.

According to currency strategists at UOB Group, the next significant support level after 1.1500 is in the March 2020 lows. “However,” the specialists note, “short-term conditions are deeply oversold, and it is not yet clear if this major support will be within reach this time.” As for a possible correction to the north, the UOB believes that only a break above 1.1635 will indicate that the British currency is not ready to fall further.

Note that the March 2020 lows (1.1409-1.1415) are at the same time the lows for the last 37 (!) years. The GBP/USD pair fell lower to 1.0800, only in 1985. As for the bulls, they will meet resistance in the zones and at the levels of 1.1585-1.1625, 1.1700, 1.1750, 1.1800-1.1825, 1.1900 and 1.2000. The readings of the indicators on D1 are similar to the readings for the EUR/USD pair: all 100% are colored red. However, here a third of the oscillators signal that the pair is oversold, which often indicates a possible correction.

The United Kingdom's economic calendar can mark Monday 05 and Tuesday 06 September when the UK Services and Manufacturing PMIs and the Composite Index (PMI) will be released. A hearing on the inflation report will take place on Wednesday, September 07, but it will be more informative, and no important decisions will be made that day.

USD/JPY: Higher, Higher and Higher

- Most analysts (60%) had been expecting a new test of the July 14 high and taking the 139.40 high last week. This is exactly what happened. USD/JPY rose to the height of 140.79, thus reaching a 24-year high. The weekly trading session finished at 140.20.

The reason for another record is still the same: the divergence between the monetary policy of the Bank of Japan (BOJ) and other major central banks, primarily the US Federal Reserve. Unlike the American hawks, the Japanese regulator still intends to pursue an ultra-soft policy, which is aimed at stimulating the national economy through quantitative easing (QE) and a negative interest rate (-0.1%). This divergence is a key factor for the further weakening of the yen and the growth of USD/JPY.

Bank of America Global Research economists expect USD/JPY to remain at high levels until a major correction in Q4 2022. Moreover, such a correction is possible only if inflation in the US shows a steady slowdown. “We expect USD/JPY to end 2022 at 127,” these analysts say. "However, the structural weakness of the Japanese yen should resurface in the longer term."

At the moment, the majority of analysts (50%) believe that USD/JPY will continue its movement to the north. Fortunately, it still has room to grow: it was worth more than 350 yen for 1 dollar back in 1971. 30% of experts expect the bulls to take a break in the area of the highs reached, and another 20% are counting on a corrective moving to the south.

For indicators on D1, the readings mirror the readings for the previous pair: 100% of them point north, while a third of the oscillators are in the overbought zone. The primary task of the bulls is to update the high of September 02 and rise above 140.80. The next goal is 142.00. Supports for the pair are located at the levels and in the zones 140.00, 138.35-139.05, 137.70, 136.70-137.00, 136.15-136.30, 135.50, 134.70, 134.00-134.25.

As for the economic events of the coming week, we can highlight the release of data on Japan's GDP on Thursday, September 08.

CRYPTOCURRENCIES: All Hope for Ethereum

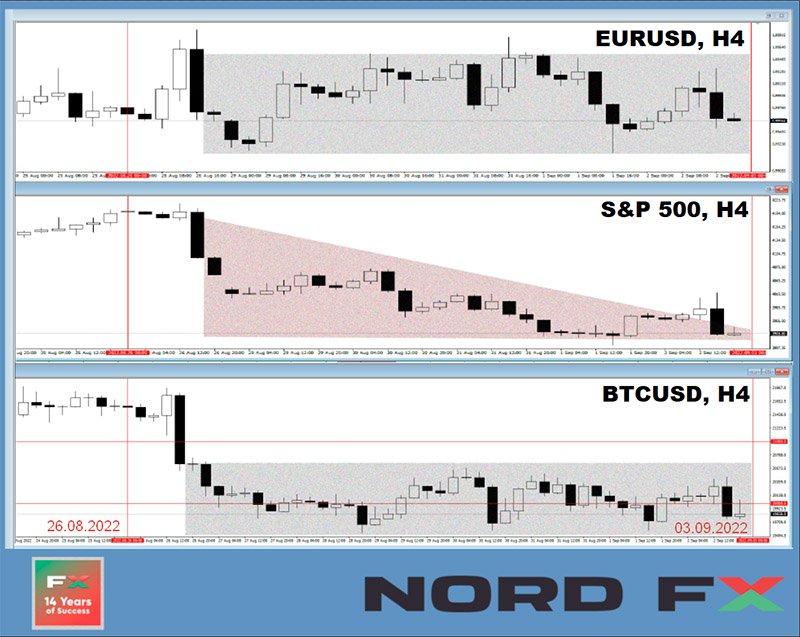

- The BTC/USD pair was moving in a narrow range along the $21.330 horizon for a week before Jerome Powell's speech on August 26. The speech of the head of the Fed collapsed risky assets, the stock and crypto markets flew down. However, if the S&P500, Dow Jones and Nasdaq stock indices continued to fall throughout the past week, bitcoin was able to stay in the $20,000 ($19,518-20,550) region, and ethereum even grew in anticipation of the transition to the PoS mechanism.

As a result, instead of the usual correlation of BTC/USDwith technology stocks, we could observe its correlation with the main major forex pair, EUR/USD these days, which moved sideways along the parity line of 1.0000. A slight recovery on Friday, September 2 was caused by the publication of data on unemployment in the US. But the pair did not go beyond the weekly trading range and bitcoin is trading at $19,930 at the time of writing the review. The total capitalization of the crypto market has fallen below the psychologically important level of $1 trillion and stands at $0.976 trillion ($0.991 trillion a week ago). The Crypto Fear & Greed Index has fallen by another 2 points in seven days, from 27 to 25, and is in the Extreme Fear zone.

Over the past 10 years, it was only in 2018 that investors suffered more serious losses. And the pressure on the crypto market continues to persist, primarily due to the tightening of the monetary policy of the US Central Bank. According to CoinShares, the turnover of cryptocurrency investment products fell in the last decade of August to the lowest level since October 2020, and the outflow of funds continued for the third week in a row. “Although […] part of this dynamic is due to seasonal effects,” the specialists explain, “we also see continued apathy after the recent price decline. We think the caution is due to the Fed's hawkish rhetoric." In addition to speculators and casual "tourists", medium-term BTC holders (with a coin history of more than 5 months) began to leave the market.

The ranks of crypto enthusiasts are rapidly thinning out. Bitcoin is “a purely speculative asset with no utility,” due to the lack of technological progress. This was stated by Justin Bons, the founder and chief investment officer of the Cyber Capital fund. He used to be a vigorous advocate for bitcoin, but changed his point of view, calling it “one of the worst cryptocurrencies”. “The world has moved forward. It used to be said that digital gold would simply embrace the best technology. This thesis, obviously, has not been fully confirmed. Bitcoin doesn’t have smart contracts, privacy technologies, or scaling breakthroughs,” Bons explained.

“The economic properties of bitcoin are incredibly weak as well. It competes with cryptocurrencies that can achieve negative inflation, high storage capacity and utility, such as post-merger ETH.” “People, for the most part, invest in the first cryptocurrency only because they believe in the price increase. They act on the same principle as participants in Ponzi schemes,” the founder of Cyber Capital believes.

Umar Farooq, the head of Onyx's blockchain division, which is part of the JPMorgan conglomerate, also voiced a lot of criticism against the crypto market. In his opinion, most of the crypto assets on the market are “junk”, and the lack of full regulation of the industry deters many traditional financial institutions from participating in the market. In addition, the technologies and practical applications of digital currencies are not well developed. Because of this, for example, they cannot be used as products such as tokenized bank deposits.

Investor and broadcaster Kevin O'Leary also believes that the price of bitcoin is stagnating due to lack of regulation. As a result, institutionalists cannot invest in this sector. “You need to use the trillions of dollars that sovereign wealth manages, but they are not going to buy bitcoin because there is no regulation,” says O'Leary. “People forget that 70% of the world's wealth is in pension and sovereign wealth funds. Accordingly, if they are not allowed to buy this asset class, they do not bet on it.”

However, the investor believes that regulation will still appear within the next two to three years. In the meantime, without a regulatory framework, cryptocurrency cannot be considered a full-fledged asset class, and bitcoin is unlikely to rise above $25,000.

Analyst Justin Bennett's forecast looks much bleaker. According to him, the recent sell-off in the stock market will inevitably lead to a fall in the bitcoin rate: “The stock sale that has taken place confirms a major bull trap and is likely to cause prolonged decline. That is, the S&P500 will fall by about 16%, and BTC by 30%-40%, to the level of $12,000.”

“BTC is testing the 2015 trend line again,” the analyst writes. -"Do not believe those who consider it a healthy phenomenon. The two long bottom wicks of 2015 and 2020 indicating strong demand are worth looking out for. This time we are seeing exactly the opposite.” According to Bennett, the main target for the bears is the pre-COVID-19 high of $3,400.

Regarding ethereum, Bennett believes that the asset is forming the top of the “head and shoulders” pattern on the chart with a downward target near $1,000: “The right shoulder of this pattern is starting to form and ETH’s drop below $1,500 is the confirmation.”

A similar scenario is given by Bloomberg analysts. They are also predicting ETH to fall below $1,000 despite its recent comeback from the August 29 lows. This is largely due to the volatility of the ethereum price in bearish market conditions. “Technical indicators of momentum and price trends show that the token’s decline from a peak near $2,000 in mid-August to the current zone near $1,500 is likely to continue,” Bloomberg said in their report.

Sentiment in the ETH community has remained optimistic lately due to the upcoming merger. However, this has not provided the asset with any immunity to the latest unfavorable macroeconomic conditions, Bloomberg analysts write. Ethereum has established promising support on its 50-day moving average. However, after the market fell on August 25-26, the asset has been below this support, which indicates the risks of a further collapse and a retest of support around $1,000.

And some optimism at the end of the review. According to a number of experts, if the transition to the Ethereum 2.0 network and the implementation of the Proof-of-Stake mechanism go as planned, this altcoin can rise sharply in price and pull the entire market up with it, primarily its main competitor, bitcoin. Recall that the update of the ethereum network is scheduled for the period from September 15 to 20. So we will find out soon which of the predictions will be correct.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Voltar Voltar