First, a review of last week’s events:

- EUR/USD. The Financial Times reported in a recent article that analysts began to have problems as Forex stopped responding to fundamental factors as before. Against the backdrop of uncertainty in global financial markets, investor risk moods dominate, which are determined by the actions of regulators on quantitative easing (QE) and support for stock markets, on the one hand, and fear of the second wave of the COVID-19 pandemic, on the other. And this fear is becoming stronger due to a new outbreak of coronavirus in China and an increase in the number of infected in several US states.

This confusion of investors is clearly visible on the EUR/USD chart. There is a side trend at the start of the week, then a 150-point rise, followed by a “ladder” down with four neat steps. Finally, the finish at 1.1180 is 80 points below the start level at the beginning of the five-day period. (Recall that two weeks ago, the final amplitude of fluctuations of the pair was only 30 points in favor of the dollar); - GBP/USD. A certain optimism regarding the meeting of the Bank of England on Thursday June 18 quickly faded. Some investors had expected an increase of £200 billion in an open market bond purchase program and even a possible reduction in interest rates. However, neither happened. The regulator kept the rate at 0.1% and increased asset purchases under quantitative easing (QE) from the current £645bn to £745bn. The pace of purchases is over £13bn a week now, so a £100bn increase in volumes corresponds to just 8 weeks of QE.

Despite some optimistic statements about the state of the British economy, the Bank of England, in fact, left the problem of its support open, saying that it would take certain steps as necessary. This position could not appeal to the market and caused another wave of sell-off in the pound, which resulted in the pair falling to 1.2350 by the end of the week; - USD/JPY. Active interest in the yen as a quiet financial harbor, which we observed from June 08 to 12, has subsided. As a result, the pair returned to the zone of a fairly long medium-term channel, which began in April, and moved along a narrow corridor of 106.55-107.65 all week, within which, at the level of 106.85, it ended the trading session;

- cryptocurrencies. Bitcoin continues to be a weapon in the confrontation between Trump and his opponents within the United States. Thus, back in 2018, Donald Trump instructed Treasury Secretary Steven Mnuchin to end the bitcoin trade. A year later, Mnuchin continued his attack on crypto assets, calling them a money laundering tool. And now, Forbes editor-in-chief Steve Forbes also called bitcoin a tool, however, changing the sign from minus to plus. According to him, cryptocurrencies are a technologically advanced “cry for help” and a tool against unstable economic policies pursued by governments, resorting to the distribution of free loans and quantitative easing.

As for crypto assets that are most interesting for investing in this unstable time, some experts increasingly call stablecoins - a type of cryptocurrency whose value is tied to precious metals or fiat money, most often in a 1:1 ratio - one stablecoin is equal, for example, to one dollar. The most popular in this digital segment is Tether (USDT) - a coin that is currently in 4th place in terms of market capitalization. According to Messari, the total issue of stable digital coins has currently exceeded $11 billion, showing a 100% increase since February.

However, stablecoins are still very far away from bitcoin. According to the analytics portal Blockchaincenter, on average around 80.8% of all cryptocurrency-related requests to Google account for BTC worldwide. Then follows Ethereum with an indicator of 13.7%, and the third in top three is Ripple - 7.7%. Kenya (94.7%) and Brazil (92.6%) have taken the leading positions in terms of interest of the population in bitcoin. Poland closes the top ten with an indicator of 86.4%. South America has become the most interested continent in the leading cryptocurrency.

True, bitcoin does not please its fans at all for the whole of June. The downtrend of the BTC/USD pair is obvious, and if in the first decade of the month the $9,500 level acted as support, then in the next ten days it became a resistance level.

The total capitalization of the crypto market is virtually unchanged and on June 19 it stands at $266 billion versus $268 billion seven days ago. The arrow of the Crypto Fear & Greed Index also froze and is still in the Fear zone - 39 against 38 a week earlier.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. It has been repeatedly said that in the current situation, many investors see the dollar as a protective currency. An ongoing pandemic in the United States is fueling fears of a new wave of coronavirus. The S&P500 index is turning down from March highs around 3150, suggesting investor doubts about a further imminent stock market recovery.

In this situation, 65% of experts supported by graphical analysis and 85% of indicators on H4 expect further strengthening of the dollar and lowering of the pair first to the level of 1.1100, and then 100 points lower.

Only 35% of analysts and 15% of oscillators on H4, giving signals of the pair being oversold, vote for the growth of the pair. The bulls' closest targets are 1.1350 and the high of 09 June 1.1425.

Regarding the publication of macroeconomic data, statistics on business activity of the EU and Germany will be released on Tuesday 23 June, and the data on the US labour market and GDP for the I quarter - on Thursday 25 June. Also, there will be a report on the ECB monetary policy meeting on this day; - GBP/USD. In addition to EU statistics, the UK Service Business Activity Index (PMI) will be published on Tuesday 23 June. According to forecasts, this indicator can grow by more than a third - from 29.0 to 39.5. In principle, the Bank of England still has enough time, depending on the development of the situation with the economy, to reduce or, conversely, increase the volume of bond purchases under QE, and even add other assets to them. The introduction of negative interest rates remains another powerful reserve. But the regulator is likely to take this step only as a last resort, if the country's economy is on the verge of collapse.

Perhaps these measures will return the active interest of the markets in the British currency. In the meantime, most analysts (60%), supported by 85% of the oscillators and almost 100% of the trend indicators on both H4 and D1, are waiting for the continuation of the downtrend of the GBP/USD pair to the May low at around 1.2070. The nearest support is 1.2265 and 1.2160.

Graphical analysis on D1 sides with the bears as well. But on H4, it sides with the bulls, as well as 40% of experts and 15% of oscillators that are in the oversold zone. Resistance levels are 1.2455, 1.2565 1.2650 and 1.2800; - USD/JPY. Market fears related to the new onset of COVID-19 on the U.S. economy could not but affect the forecasts regarding the future of this pair. Thus, 60% of analysts believe that the potential of the yen as a haven currency has not yet been exhausted, and they prefer the Japanese currency in the fight against the dollar. However, a powerful downward movement, in their opinion, should not be expected, and the ultimate goal will be the horizon of 106.00. The next level of support is located 100 points below, however, it is now unlikely to be achieved.

40% of experts vote for the strengthening of the dollar and the growth of the pair, expecting its rise to the 108.00 zone. The nearest resistance is 107.65.

As for technical analysis, 90% of the trend indicators on Η4 and 100% on D1 are colored red. The picture is slightly different among oscillators. Here, 90% of them point south on H4 and 70% on D1, while the rest signal that the pair is oversold; - cryptocurrencies. There is still a debate about whether bitcoin is a risky or protective asset. In fact, if you compare the BTC/USD charts with the situation on the markets, you can see it in both roles. At the same time, it can be assumed that in the event of a serious, comprehensive collapse, investors are more likely to get rid of cryptocurrencies rather than traditional assets.

In the meantime, one can observe the growth of interest of large investors in the reference cryptocurrency. According to the analytical service Glassnode, the number of “whales” with wallets of 1000 or more coins is now approaching the level fixed at the end of 2017, when the BTC price was coming close to $20,000. Institutional activity is also confirmed by data from the Chicago Mercantile Exchange (CME), where applications for bitcoin options increased tenfold between May 10 and June 10. All this suggests that after a relative lull in recent weeks, we can expect sharp jumps in volatility, and the “whales” can provoke both strong growth and a collapse of quotations at any moment.

An interesting point of view was expressed by well-known trader and analyst Tone Vays, who believes that current bearish sentiment can positively affect the growth of the first cryptocurrency in 2021. The absence of To the Moon, in his opinion, should make people so angry that they started selling bitcoin. To the Moon means the continuous growth of the cryptocurrency rate in a geometrical progression. It is the lack of such growth that will trigger its rapid rise in the future. According to the analyst, "for bitcoin to rise, people must hate it."

"Until the price breaks through $10,000, I will expect the price to fall," Vays concluded his ForkLog interview. – If we fall by the end of the summer, I think it will be somewhere around $7,000. But the first cryptocurrency will not fall below $6,000."

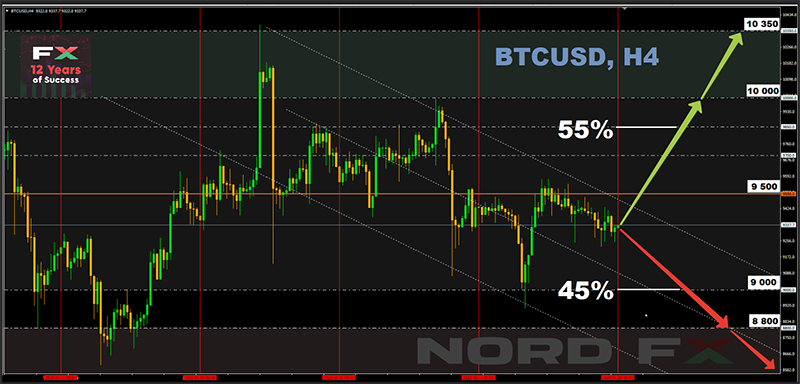

Regarding the current situation, 55% of experts believe that the pair will still be able to gain strength and once again assault the $10,000 sign level, the remaining 45%, on the contrary, are waiting for the BTC to drop to $8,500-8,800. The next support level may be a 200-day moving average in the $8.350 zone.

In addition to bitcoin, Ethereum has recently attracted serious attention of experts: according to CoinMetrics estimates, the growth of transactions related to it has reached a 27-month high. This happened primarily due to decentralized financial applications (DeFi) and Tether Stabelcoin (USDT), the number of transactions with which on Ethereum blockchain has increased by 450% since early 2020.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Voltar Voltar