First, a review of last week’s events:

- EUR/USD. Tensions between the U.S. and China continue, which can not but affect the markets. President Trump said he will respond “very strongly” to Beijing’s legislative initiatives. This applies, in particular, to the desire of the PRC to strengthen control over Hong Kong, which has previously served as the cause of unrest in this country. If China continues to take this path, Donald Trump said on Thursday May 21, he “will deal with this issue very decisively.” In parallel, the US administration continues to point to the Celestial Empire, as the source of the global coronavirus pandemic, and requires appropriate compensation from it.

In addition, the United States announced the withdrawal from the “open skies” treaty, which could be a harbinger of a new arms race and reinforces the expectation of another round of geopolitical tensions.

As for the current economic indicators of the USA and the Eurozone, in spite of certain improvements, it is still very, very early to talk about their confident recovery. So, despite the fact that, according to Markit, the composite index of business activity in the manufacturing sector of the Eurozone in May rose from 13.6 to 30.5, consumer demand continues to fall, and the number of jobs continues to decline at a tremendous speed.

In the US, business activity also went up, but there are also huge problems with unemployment. The number of initial applications for unemployment benefits fell slightly during the month, from 2,687K to 2,438K, and the number of Americans receiving this benefit exceeded 25 million.

This situation of economic uncertainty both in the USA and in Europe does not allow investors to give preference to any of these currencies and has been holding the EUR/USD pair in the side corridor 1.0750-1.1000 for the second month running. So last week, the pair first rose to the upper border of this channel, and then sank into its central zone, completing the five-day period at around 1.0900; - GBP/USD. A whole block of UK macroeconomic indicators was published last week, which turned out to be quite contradictory. It seems that the situation on the labor market has improved: the unemployment rate was 3.9% instead of the forecast value of 4.4%, and business activity in the service sector did not fail either — the Markit index showed an increase from 13.6 to 30.5, the preliminary index of supply managers (PMI) rose from 32.6 in April to 40.6. On the other hand, the consumer price index (CPI) fell from 1.5% to 0.8%, and this despite the fact that the target level of the Bank of England is 2%.

The inflation rate in April proved to be the slowest since August 2009, and such a decline in inflation could prompt the Bank of England to lower interest rates further. So, The Bank's Governor, Andrew Bailey, said on Thursday that it would be foolish to rule out the possibility of introducing negative interest rates. Only a week ago, he had denied the possibility.

In general, as was already said, the situation last week was quite contradictory, and perhaps that’s why the pound slowed down, and the dynamics of the GBP/USD pair as a whole repeated the dynamics of EUR/USD: having found the local bottom at 1.2070, the pair turned around and went up to the height of 1.2295. This was followed by another reversal and decline, including by Andrew Bailey's statement, to 1.2170; - USD/JPY. Japanese Finance Minister Taro Aso and Bank of Japan Governor Haruhiko Kuroda issued a statement on Friday May 22 that the government and the country's Central Bank would work together on putting the economy back on the path of growth. The high officials have noted that the number of bankruptcies in Japan has grown rapidly over the past month. In this regard, Kuroda announced a program worth 30 trillion yen, under which companies affected by the coronavirus pandemic will be able to obtain loans without collateral and at a zero interest rate. Such steps by the regulator to ease monetary policy push the pair up, although this movement can not be called strong. Over 2.5 weeks, its quotes increased from 106.00 to 107.60, as a result of which, having drawn the letter V, the pair returned to where it was already in early and in mid April, to the zone 107.30-108.00;

- cryptocurrencies. Let's start with secrets and mysteries. For the first time in a year, unknown people transferred more than 28 BTC ($258 thousand) to an anonymous address from the wallet where the bitcoins stolen from the Bitfinex exchange were stored. But this is not a sensation, but a topic for police investigation. The sensation is that Bitcoins, possibly belonging to Satoshi Nakamoto himself, also began to move! The crypto community has always been interested in coins mined at the origin of the network when they were mined by only a few people, including the creator of bitcoin. And now 50 BTC, which had been lying dead weight since 2009, are in motion.

According to some analysts, these and other processes are directly related to the consequences of halving. Against the background of the falling hashrate in the last recalculation, the complexity of bitcoin mining also decreased, but this has not helped to normalize the situation so far. Despite the best efforts of the bulls, the BTC/USD pair never managed to break the key level of $10,000. But, as you know, what does not grow, falls. After not waiting for the long-awaited jerk up after the halving, many traders began to eliminate their long positions and take profits, as a result of which the quotes of the main cryptocurrency fell by about 10%, to the level of $9,000.

As a result of the sell-off, the total capitalization of the crypto market fell from a May 18 high of $273 billion to $246 billion on May 21, but the value of the Crypto Fear & Greed Index is about the same level as a week ago, 42 vs. 44.

It should be noted that, despite the small drawdown of BTC/USD, the profitability of bitcoin this year was far ahead of gold. The precious metal has risen in value by 12% since January, while bitcoin has risen by about 30%. The advantage of the main cryptocurrency over the stock market looks much more impressive. For example, JPMorgan quotes fell by 37.2%, as a result of which BTC bypassed this bank in terms of market value growth by more than 200%.

But the most impressive result was not bitcoin at all, but Ethereum, which has "grown fat" by almost 55% since the beginning of the year. According to a number of experts, ETH has very good prospects as its network becomes increasingly active. This is due, among other things, to the launch of decentralized financial applications (DeFi), which reduce the circulation of coins, creating an effect similar to the BTC halving.

The main altcoin was supported by the author of the Harry Potter series of novels, J.K. Rowling. Previously, she tried to figure out bitcoin, after which she stated that she was only “trolling bitcoin in the hope of increasing her significant ethereum assets.” True, this turned out to be a joke, but additional PR to ETH coins was provided.

At the moment, apologists for the main cryptocurrency do not consider ETH a competitor - the share of bitcoin in the market is 65% compared to 8.4% for ethereum. But it is enough to recall the middle of June 2017, when these coins were close to parity - 38% and 31%, and ask the question: why should the situation not happen again?

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. As already mentioned in the first part of our review, while maintaining the current status quo, the pair has a lot of chances to stay within the side channel 1.0750-1.1000. However, further escalation of geopolitical tensions, reinforced by the repeated outbreak of the COVID-19 pandemic, is able to return gloomy moods to the markets again. Most likely, there will be no new panic, but interest in protective assets such as the US dollar will begin to grow again. For this reason, most experts (70%) do not rule out a breakthrough of support 1.0750 and a decrease of the pair to the lows of March in the area of 1.0635. The possibility of raising the pair to the zone 1.1100-1.1240 in the medium term is considered only by 30% of analysts.

Among the events that should be noted in the coming week are the release on May 28 of data on orders for durable goods, unemployment and US GDP, as well as, a day later, on May 29, data on the consumer market in the Eurozone; - GBP/USD. Despite some positive macroeconomic data, the overall situation in the British economy does not look very happy. And this may push the Bank of England to increase the quantitative easing (QE) program by £100 billion and lower the key interest rate to negative values. All these factors continue to pressure the pound, especially as the head of the Federal Reserve, Jerome Powell, categorically stated that his organization is not considering the possibility of imposing negative rates on the US dollar.

At the moment 70% of analysts believe that the last week's correction has finished, and the pair is expected to further decline first to the horizon of 1.2075, and then to support 1.2000. In the event of a breakout of this important level, the pair will rush to the lows of March: 1.1640 and 1.1400.

85% of oscillators and 100% of trend indicators on H4 and D1 side with the bears. The remaining 15% of oscillators give signals that the pair is oversold, which 30% of experts agree with. In their opinion, the pair is expected to return first to the central zone of the channel 1.2165-1.2650, and then, possibly, rise to its upper boundary.

The compromise option is offered by graphical analysis on D1, which draws first a rise to 1.2350, and then a decrease by mid-June to 1.1400; - USD/JPY. A strong decline in activity in the Japanese economy (the second largest economy in Asia and the third in the world after the economies of the USA and China) continues, and therefore inflation in the country will decrease, and production growth will slow down at least until early 2021. The Bank of Japan has been trying for a long time to warm up inflation by launching various incentive programs and keeping key rates in the red zone. However, there are still no major gains in sight, and further steps in this direction will only increase the pressure on the yen. The demand for the yen as for the haven-currency is on the opposite side of the scale, which will rise as the political and economic conflicts between the US and the PRC escalate. But this factor is more likely to affect the cross-rates of the Japanese currency, as the investors also see the dollar as a protective asset, even stronger than the yen.

However, 65% of experts expect the return of the USD/JPY pair to the minimum of May 06 in the 106.00 zone at the moment. Supports are 107.30, 106.80 and 106.20. Further growth of the pair is possible according to 35% of analysts. The targets are 107.85, 108.00, 108.50 and 109.25; - cryptocurrencies. Traditionally, first about the medium - and long-term forecasts of well-known crypto enthusiasts. So, the Bloomberg Agency cites analyst Simon Peters that within the next 18 months, bitcoin will be able to break above $20,000. According to Peters, if the US and many other states do move to negative rates, the capital investment in bitcoin will start to grow at a rapid pace. After that, taking a mark of at least $20,000 will be inevitable, and the appearance of BTC/USD near the height of $ 50,000 is not ruled out.

A somewhat smoother takeoff is drawn by entrepreneur and author of the bestseller "Rich Dad, Poor Dad" Robert Kiyosaki, according to whom, the intention of the US authorities to pour trillions of dollars into saving the pension plans will kill the economy of this country, which will cause the price of bitcoin to grow to $75,000 in three years.

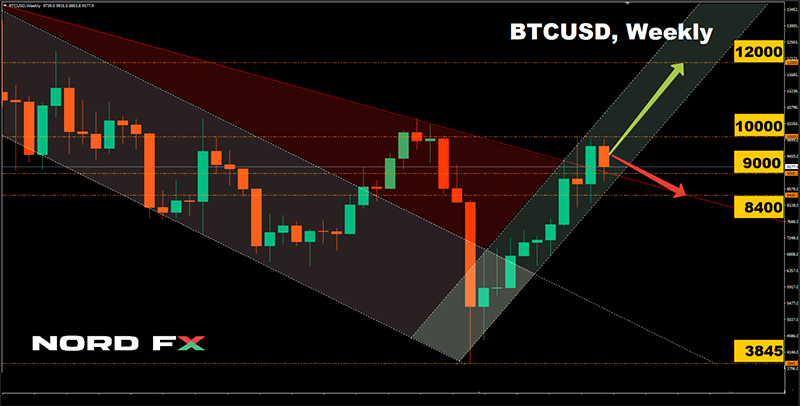

If Kiyosaki measures the future of BTC by three years, renowned trader Tone Vays capped his forecast to just three days. He said live on ForkLog that “Bitcoin could rise very seriously. How high? Somewhere up to $12,000,” Vays said. And he added: "If we get stuck now and start falling to $9,000, I will expect us to fall below $8,000. Three days have passed, bitcoin is stuck at $9,000, and now, according to Vays's forecast, should we wait for its further collapse?

If we talk about the scenario for the coming week, here the votes of experts were more or less evenly distributed in the range of $8,400-10,000. But if we move on to a longer-term forecast, 80% of analysts are sure that bitcoin will still be able to gain a foothold above the $10,000 horizon by the end of June. However, of course, there are also pessimists who remind, as recently, between two “bad” dates — February 13 and March 13, just a month away, bitcoin collapsed from $10,480 to $3,845, making one think of its ultimate collapse.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Voltar Voltar