First, a review of last week’s events:

- EUR/USD. While in the United States, decisions to allocate money to revive the economy are made quickly enough, in the Euro Zone this is a process that requires a long discussion and agreement between the participating countries. And this can not but put pressure on the euro. So, at its meeting on April 23, the European Council seems to have reached an agreement on measures to help the economy, suggesting that the European Commission create a Recovery Fund in the amount of approx. €1 trillion, but they could not clearly agree as to where to get this money from.

The US administration continues to flood its economy with money. The decision on the next tranche of almost $0.5 trillion, which, for the most part, will be used to support small businesses, was made last week. Apparently, such steps are beginning to bring results. At least the number of applications for unemployment benefits fell by 15% in the United States, while orders for capital goods rose from -0.8% to 0.1%.

The result of this distribution of forces was a smooth weakening of the Euro by about 100 points, which fully confirmed the forecast given by the majority (60%) of our experts, who had expected to see the pair in the 1.0750 support zone. This was followed by a correction and the pair finished at 1.0820; - GBP/USD. Analysts' forecasts for the future of the British currency were quite vague. As for the dynamics of the pair, it was most accurately described by graphical analysis that predicted its decline in the first half of the week and the subsequent correction to the north in the second half. And so it happened: at first the pair felt for the local bottom at the level of 1.2245, then rose to the level of 1.2415, and completed the five-day period in the zone of 1.2365;

- USD/JPY. The 107.00 zone has been a significant level of support/resistance for months and even years. It is close to it that the pair has been moving for the past few days. The vast majority of analysts (70%) expected that bears would try to break this level from top to bottom, which they did throughout the week. However, none of the attempts was successful, the bears were not even able to approach the treasured horizon. As a result, the pair stayed in a very narrow side channel, 107.25-108.00, inside which, at the level of 107.40, it ended the trading session;

- cryptocurrencies. Last week was very successful for Bitcoin. Throughout its first half, a fight continued for the height of $7,000. It started on March 20, and, as most analysts (60%) had expected, the victory, in the end, was with the bulls. On Thursday, April 23, the price of the main cryptocurrency reached the mark of $7.750 — the highest value Bitcoin has been able to rise to after the market collapse on March 12-13. Thus, the growth over this period has amounted to about 100%.

In addition to the upcoming BTC halving, the cryptocurrency market was assisted, according to several analysts, by the growing correlation between Bitcoin and the US stock market (S&P 500) and oil. Bitcoin is still a risky asset, but it is gradually attracting more and more attention from serious investors. According to such an authoritative publication as Bloomberg, now that the world is in crisis, and states are printing huge amounts of money, Bitcoin has every chance of becoming a quasi-currency like a digital version of gold. And the researchers believe, it will successfully cope with this task.

After a dash of the BTC/USD pair to the height of $7,750, a rebound followed and on Friday, April 24, the pair moved to a sideways movement in a fairly narrow channel of $7,440-7,600. The total capitalization of the crypto market has passed the mark of $215 billion, adding about 7% over the week, and the Crypto Fear & Greed Index has grown from 15 to 20.

As for the top altcoins, their growth was much more modest. Ethereum (ETH/USD) grew by 8%, Ripple (XRP/USD) - by 2.5%, and Litecoin (LTC/USD) returned to the Pivot Point level in the first half of April; - stock market. Since the NordFX brokerage company offers its customers trading not only in the Forex and crypto markets, but also in transactions with stocks, stock indices, as well as investments in special investment funds, we decided to expand our review to this very important segment of financial markets.

The US stock market has been growing lately amid the news of the adoption by the Senate of a law on the allocation of additional state support in the amount of $ 484 billion. The growth of risk assets was also helped by expectations of a gradual resumption of economic activity. Two US States have already announced the partial lifting of the quarantine, and several more States are in line. Decisions on easing restrictions have also been made in a number of European countries.

Last week, the leaders of online services such as Amazon, Netflix, Apple showed their best performance, although Amazon is considered the choice of consumers, while Apple and Google are the communication services. But the shares of oil companies, in the conditions of the fall of the nearest futures for “black gold” to negative levels, did not please either their owners or traders who opened the they have long positions.

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. The US Federal Reserve continues to flood the markets with fantastic amounts of dollar liquidity, which, in theory, should lead to a depreciation of the dollar. But it's just a theory. According to forecasts, the us budget deficit will be $3.8 trillion or 18.6% of GDP, and the national debt will grow to 107% of GDP. However, the cost of servicing this debt will remain at the same acceptable level of 2% of GDP. This is due to falling rates on US Treasury bonds. Moreover, the external demand for US government debt is still high, which gives the Fed additional opportunities for an even softer monetary policy. Of course, this will not save the United States from a recession, but the damage to the European economy is expected to be much greater.

Among the most important events, first of all, we should pay attention to the decisions of the Fed and the ECB on interest rates and the comments of their management on April 30. Also, on Thursday, a whole block of macroeconomic indicators will be released, including data on the labor market in Germany, the United States, and the Eurozone. In addition, we will learn about the state of the consumer market and the GDP of the Eurozone.

A day earlier, on Wednesday, the US GDP data will be released, and a day later, on Friday, the US manufacturing ISM and employment indices will be published.

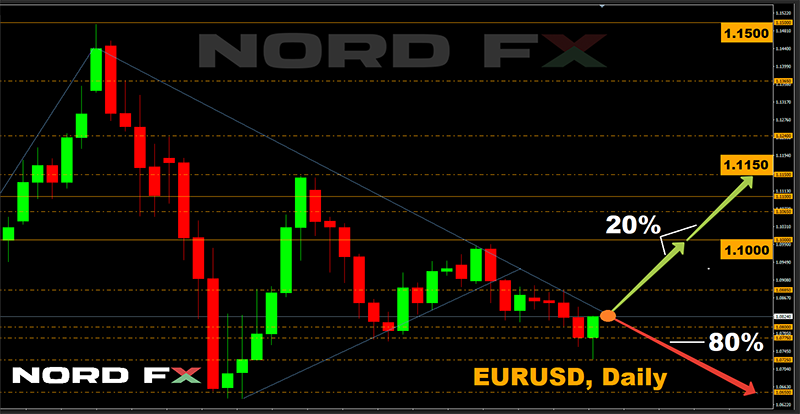

At the time of writing this forecast, the vast majority of analysts (80%), supported by 70% of the oscillators and 90% of the trend indicators on D1, expect further strengthening of the dollar and a fall of the pair. Support levels are 1.0775, 1.0725, the target is 1.0650.

Only 20% of experts support the growth of the pair, with graphical analysis on H4 on their side. The resistance levels are 1.1000, 1.1065, 1.1100 and 1.1150;

- GBP/USD. As we have already written, Britain is projected to be among the countries most affected by coronavirus. The political and economic risks associated with Brexit have not been reversed either. However, investors hope that the final solution of issues related to withdrawal from the EU will be postponed for a longer period or, at least, in the current situation, the British will be able to bargain from Europe more advantageous terms.

Most experts, as in the case of EUR/USD, expect the pair to fall. However, in this case there are significantly fewer of them – 60%. 85% of trend indicators and only 40% of oscillators on D1 are colored red. 15% of the oscillators vote for the growth of the pair, the rest remain neutral. Graphical analysis on D1 expects that the pair will first fall to the horizon of 1.2200, and then rise to the height of 1.2525.

Support levels are 1.2245, 1.2200, 1.2165, 1.2000. Resistance levels are 1.2485, 1.2525, 1.2650 and 1.2725; - USD/JPY. No one seems to care about this pair right now. And no matter what the Bank of Japan does at its meeting on Tuesday, April 28, this will not affect the attitude of investors. Although, with a high probability, surprises from the Japanese regulator should not be expected.

Indicators on both timeframes are overwhelmingly red (75-100%), which indicates that the bears will again rush to break through the support of 107.00. If successful, the pair may drop to the 105.80 horizon. The next targets are 105.00 and 104.40, but with the extremely low volatility of the past week, their achievement is unlikely.

Experts appear to be looking at the narrow corridor where the pair were trapped. Therefore, unlike the indicators, their opinions are divided almost equally: 55% support the bears, 45% - the bulls. The nearest resistance is 108.00, then 108.50 and 109.50; - cryptocurrencies. More and more voices have been heard recently foreshadowing the main cryptocurrency with a very successful year. The reasons, in addition to the May halving of Bitcoin, have been voiced many times. This is a general negative macroeconomic background, massive printing of money by Central banks, rising unemployment and falling oil prices. Thanks to precisely these factors, ShapeShift CEO Eric Voorhees believes that in twelve months the Bitcoin exchange rate could reach $ 50,000 with a 80% probability.

Anthony Pompliano, co-founder of investment company Morgan Creek Digital, agrees with Voorhees, having declared that BTC is on the threshold of a new long-term trend: from current levels to $100,000.

Another forecast is given by the cryptocurrency analyst Dave the Wave. In July 2019, he gave a correct prediction of a decline in the BTC from $11,600 to $6,000 by the end of the year, saying that the first cryptocurrency was up to a parabolic drop. Now, he updated his long-term forecast using curve models based on the BTC price history. In his opinion, the Bitcoin volatility will decline, but it will still face a few ups and downs. Dave the Wave expects the first cryptocurrency to grow to $130,000 by 2023 and then gradually decline to $40,000. Then, the Bitcoin exchange rate will again gradually grow, and by 2029 it could reach $400,000.

Bloomberg analysts expect a decrease in volatility in their medium-term outlook, and this, in their opinion, is a very important observation: it was the unusually low level of volatility that was observed in October 2015 that became a harbinger of a bull rally, with the Bitcoin price rising to historic highs in December 2017. They believe that such a rally, can happen again now.

65% of experts expect the BTC/USD pair to grow in the coming week, although the targets here are much more modest and are far from $100,000, and even more so from $ 400,000. The minimum task for the bulls, in their opinion, is to secure the pair in the zone of $7,750-8.250. And then, pushing off from it, break through resistance at $ 9,000.

The remaining 35% of experts believe that the pair will continue to fluctuate at the level of $6,700-7,400, and in case of breakdown of its lower border, it may drop to support around $6,000. - stock market. Last week, online services such as Amazon, Netflix, and Apple were in the lead. According to forecasts, in the coming days we will also hear about the “big TECH five”.

Amazon, the giant of e-commerce and cloud computing, is a clear beneficiary of quarantine, as is Netflix. Amazon is expected to grow 22% and 21% over the next two quarters. Apple rose 82% in 2019 compared to 32% of S&P500 in the year, where revenue fell by 2% and EPS (company's earnings per share) remained unchanged.

In the second quarter, EPS for Google and Facebook is expected to grow by 35% yoy and will have positive revenue growth. Microsoft is expected to show stronger growth in the second quarter of this year, which is highly unusual in terms of quarantine and travel ban for people.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Voltar Voltar