First, a review of last week’s events:

- EUR/USD. Analysts have been talking about this for so long and it has happened: on Wednesday September 18, the US Federal Reserve lowered its key interest rate by 0.25% to 2.0%. But since they have been talking about this for a very long time, the market worked out this scenario a long time ago, and no "epoch-making" jumps in the rate have occurred. On the contrary, the volatility declined, and the pair switched to a sideways movement in the corridor 1.1000-1.1075, which is already well-known to traders.

We have already talked in our previous forecasts about this Pivot Point zone of the last two months, which was formed as a result of uncertainty prevailing in the market. Last week was a confirmation of this. So, on the one hand, the Fed’s press conference on Wednesday went without extenuating rhetoric, reinforcing the view that there will be no further rate cuts this year. But the very next day, the Banks of Switzerland and England abandoned the policy of easing at their meetings as well, maintaining their rates at the same level, and the Bank of Norway did raise the key rate. This only exacerbated the uncertainty by forcing the EUR/USD pair to move strictly east; - GBP/USD. The pound continues winning back losses from the expectation of an unregulated Brexit, adding 5% against the September 3 low of 1.1958. This week, European Commission President Jean-Claude Juncker announced his readiness to abandon the idea of the backstop on the Irish border if British Prime Minister Boris Johnson comes up with something new and viable. This pushed the pound further up, as a result of which the pair reached the corridor 1.2440-1.2580, in which it was already moving in July, and completed the five-day period at the level of 1.2470;

- USD/JPY.The pair updated its medium-term high in the middle of the last week, reaching the height of 108.47. This happened against the backdrop of the decision of the Bank of Japan to maintain the target yield of 10-year government bonds in the zero zone. A statement by the head of BOJ Haruhiko Kuroda, who stated that the issue of further rate cuts is still relevant, also helped weaken the yen.

However, as usual, Trump's words made a greater impression on investors. And the US president said this time that Washington had reached an “initial” trade agreement with Tokyo, according to which the United States promised not to raise tariffs and introduce quotas for Japanese cars, and Tokyo would reset the duties on American wine within seven years.

Cars against wine - such a deal is clearly in favor of Japan. In addition, due to the escalation of the geopolitical conflict in the Middle East, the demand for protective assets has grown, among which, of course, is the yen. As a result, the pair went about 100 points in the opposite direction, ending the week session at 107.55; - Cryptocurrencies. Last week pleased some and forced some to have cold sweat due to an unexpected sharp drop in bitcoin (BTC/USD) by 6%, and then due to its unexpected growth, for no apparent reason. This drop caused the widespread closure of long positions: on one BitMEX crypto exchange alone the closed positions were worth $150 million.

The most likely explanation for what happened is the game of major capital against small traders, disappointed by the lack of a quick rise in bitcoin. At the same time, large players, not wanting to cause a panic collapse, do not let the pair fall below acceptable levels, keeping it in a comfortable range with a Pivot Point of $10,000.

Interestingly, the main altcoins seem to have begun to live an independent life, only partially copying the movements of the reference cryptocurrency. So, Ethereum (ETH/USD) has risen in price by 35% over the past three weeks, Litecoin (LTC/USD) - by 30%, and Ripple managed to jump up by 27% in just 4 days (from September 14 to 18). And this despite the fact that the maximum fluctuations in bitcoin this month did not exceed 9%.

The most logical, in our opinion, explanation is the subtlety of the market for altcoins. Unlike bitcoin, it is much easier to manipulate the exchange rate here, even with significantly lower amounts, which cannot but attract speculators eager for quick enrichment.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

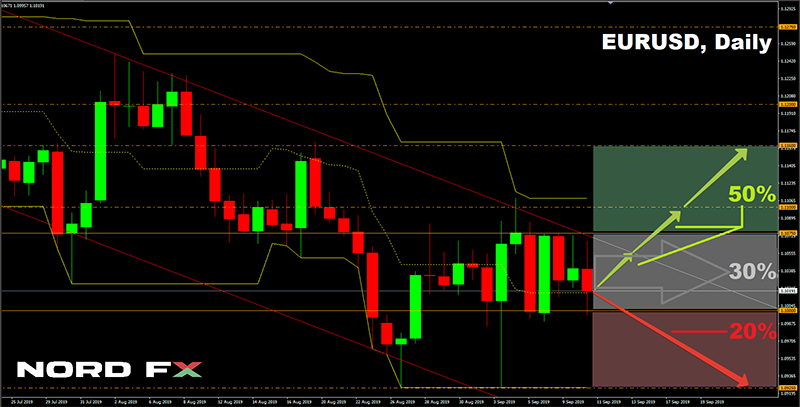

- EUR/USD. Unable to overcome the strong resistance level of 98.23, the USDX index is moving in a side channel. The pair EUR/USD is also moving east. Most likely, bearish factors such as quantitative easing (QE) in Europe and unregulated Brexit have already been played by the market. Objectively, the US economy is stronger than the European one. But the dollar-driven trade wars launched by President Trump are constantly hampering the dollar. And now there is also expectation of a full-fledged hot war in the Middle East over the drones’ attack on the oil facilities of Saudi Arabia, which Iran is accused of organizing. It is clear that the United States will surely intervene in this conflict.

All this leads to the closure of short positions on EUR/USD, and it is possible that the pair will not be able to update the September low at 1.0925. Half of the experts agree with this scenario, expecting it to grow to the height of 1.1100. The next target is 1.1160. 20% of analysts believe that the pair will nevertheless go down to around 1.0800. And 30%, supported by the oscillators on D1, expect the continuation of the side trend;

- GBP/USD. According to the calculations of the Organization for Economic Co-operation and Development, unorderly Brexit will subtract 0.5 pp from the Eurozone GDP, and as much as 2 pp from the Misty Albion GDP(!). Such a fall, according to the OECD experts, will put the Eurozone on the brink of a collapse, and Britain will plunge into a deep recession. Responding to such forecasts, markets, like ordinary consumers, tried to get rid of the pound, as a result of which this currency approached the 2016 lows.

If you look at the graph, you can see that three years ago, having pushed away from zone 1.1945-1.1985, the pair went up and, having passed 2,400 points, reached the height of 1.4345 in January 2018. This “historical” experience is pushing some investors to buy the pound right now, hoping that the situation with Brexit will be somehow settled, and the Bank of England, fighting inflation, will begin to raise interest rates.

Among analysts, the number of supporters of this development today is 40%. 80% of the oscillators on D1 also agree with this prediction. If the bullish scenario is implemented, the pair will first rise to the zone 1.2575-1.2645, and then 100 points higher. The most ambitious forecasts indicate the pair growth to the level of 1.3100 by the end of the year.

However, at the moment, the Brexit question remains open, and therefore most analysts (60%), supported by 70% of the oscillators on H4 and graphical analysis on D1, maintain a pessimistic mood, expecting that during the autumn, the pair will try again to approach its absolute low over the past 228 (!) years when on October 7, 2016 one pound was worth a little more than 1.19 dollars (in 1791 the pair GBP/USD was at around 4.55). The closest support areas are 1.2385-1.2400, 1.2280-1.2300, 1.2065-1.2200, 1.1955-1.2015; - USD/JPY. For the reasons described above, most experts (65%) have supported the bears by voting for the fall of the dollar and the return of the pair to the area of 105.75-106.75.85% of indicators on H4 agree with this scenario. However, 15% of oscillators are already giving signals about the pair being oversold.

35% of analysts consider the strengthening of the yen a temporary phenomenon and therefore predict the pair will rise to the height of 109.00.

As for the graphical analysis, at the first stage it draws the pair's growth to the horizon of 108.50 and then its fall to the level of 106.75. The following support levels are 105.75 and 105.00. The target of the bears is the low of 08/26/2019 at the level of 104.45; - Cryptocurrencies. Despite the constant assurances of the crypto market “guru” about the inevitable rise of Bitcoin to 50, 100 or 200 thousand dollars, its price still remains in the consolidation zone, moving along the $10,000 horizon. Moreover, the volatility of the BTC/USD pair is decreasing day by day. And it seems that this situation is quite suitable for large players building this low “fence” and earning on the volume of transactions, and not on the frantic jumps of quotes.

Of course, a breakthrough can occur at any time. However, it is difficult to say in the current situation when this will happen and in which direction the price will go. We only note that at the moment, 65% of the experts surveyed remain bullish optimistic, and 35% are expecting the pair to drop to around $8,000.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

Voltar Voltar