First, a review of last week’s events:

- EUR/USD. The main economic event of recent days was the failure of the US-China trade negotiations. The United States decided to increase duties on a number of Chinese goods from 10% to 25%, after which the Chinese Ministry of Commerce announced that it would be forced to take retaliatory measures. However, the market reacted rather sluggishly even to these statements, the range of weekly fluctuations of the pair did not exceed 85 points, and it could not penetrate the resistance 1.1250;

- GBP/USD. The movements of this pair are still dependent on just one short word: Brexit. The hope for the agreement of the British Prime Minister Theresa May with the opposition leader Jeremy Corbin regarding the conditions for leaving the EU melted away like the morning fog. As a result, the British currency collapsed by more than 200 points, reaching the local bottom at 1.2965. After that, a correction followed, and the pair completed the week at 1.3000;

- USD/JPY. Judging by the charts of the major pairs, the market events affect mostly the Japanese currency. The problems in the US-China negotiations and a decline in investors' inclination for risky investments allowed the yen to win back about 150 points from the dollar and return to the values of the end of March in the zone 109.70-109.95;

- Cryptocurrencies. Whether Bitcoin will ever become a sustainable global asset is still a question. However, the fact that it regains a place in the TOP of objects for investment is a fact. A recent study by Binance research showed that since the beginning of 2019, the value of the reference cryptocurrency has grown by more than 50%, the price of oil has increased by 33%, technology stocks have grown by 18%, and the gold has lost about 1% of its value. Such advanced dynamics of BTC cannot leave investors indifferent. For example, according to the consulting agency deVere Group, 68 percent of wealthy people with a fortune of more than $500 million intend to invest in Bitcoin in the next 2-3 years (700 businessmen from the United States, Great Britain, Switzerland, Spain and the UAE participated in the survey).

In the meantime, the market capitalization has come close to the $190 billion mark, having updated the highs since the beginning of the current year, and Bitcoin is implementing the May scenario at an accelerated pace. Recall that 70% of experts have given a forecast that the BTC/USD pair should rise above $ 6,000 during May. However, this happened as early as on May 3, and it reached $6,400 by the end of last week.

As for the main altcoins, unlike their “older brother”, they showed either zero, like Ethereum (ETH/USD), or a negative trend: Litecoin (LTC/USD) fell by 11.0%, and Ripple (XRP/USD) - by 9%.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. According to the market, at the moment, China’s deal with the United States is mostly needed for China, whose economy is under great pressure. However, the continuation of the trade war could turn into major problems for Americans, pushing the country into recession. In such a situation, according to the May poll of the Wall Street Journal, 51% of experts believe that, instead of tightening monetary policy, the US Federal Reserve is more likely to ease it. (In April 44% of respondents voted for easing, and they were only 19% in March). Now, 60% of experts supported by graphical analysis on D1 prefer the euro, believing that the pair may grow to the zone 1.1280-1.1325 in the near future. The next targets are the highs of March 1.1400 and 1.1450.

On the other hand, China’s current problems may have a negative impact on the economy of the Eurozone, which has very close ties with it. And this gives rise to some concern regarding the strength of the European currency. In the transition to the monthly forecast, 70% of the experts side with the bears, believing that the pair will continue to move along the medium-term downward channel and again test the end of April low at 1.1110. Graphical analysis on H4 and 15% of oscillators on H4 and D1, which give signals the pair is overbought, side with the bears as well. The nearest support is 1.1175 and 1.1140;

As for the upcoming events to which you should pay attention, there will be data on foreign direct investment in the Chinese economy, which will be released on Monday, May 13, as well as statistics on the GDP of Germany and the Eurozone and data on retail sales in the United States on Wednesday, May 15. - GBP/USD. Statistics on the UK labor market will be published on Tuesday, May 14. However, whatever these indicators may be, the main problem remains Brexit. There is a steady feeling that Prime Minister May may not be able to solve this issue at all, and this continues to put pressure on the British currency.

65% of analysts believe that the pound will continue to fall, with which most trend indicators and graphical analysis on H4 and D 1 agree. The nearest support is 1.2985, the target is April lows in the 1.2870 zone.

The remaining 35% of experts vote for the pair's return above level 1.3100, the target is 1.3200. As for the oscillators, at the time of writing the forecast, they have taken a neutral position on both timeframes; - USD/JPY. 55% of analysts, supported by graphical analysis and 85% of indicators, believe that, as a safe haven currency, the yen will continue to strengthen its position, pushing the dollar further down to support 109.00 and then another 50 points lower. At the moment, only 45% of experts and 15% of oscillators side with the bulls, signaling the pair is oversold. However, in the transition to a longer-term forecast, it is already 80% of analysts who expect the pair to return to the range of 111.00-112.00;

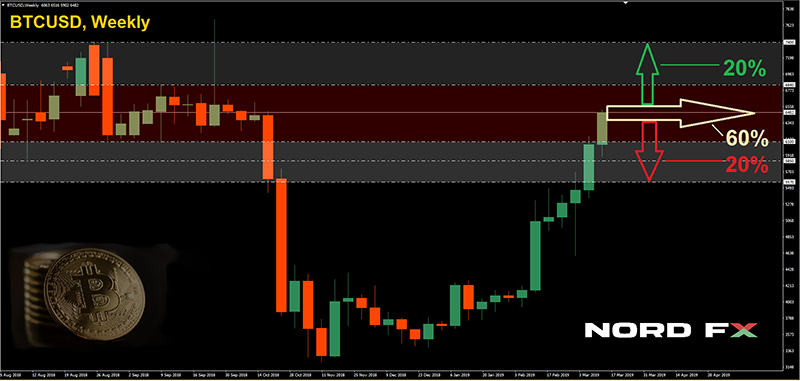

- Cryptocurrencies. So, Bitcoin has reached a very strong support/resistance zone, noted back in February 2018. Analysts of the Galaxy company assume that this coin can rise in price to 400 thousand dollars in future. But this will happen only if it loses full decentralization and operates according to the rules of large institutional investors. In the meantime, 60% of experts believe that in the near future the pair will fluctuate in the range of $6,100-6,840, where it stayed in last September-October, before collapsing in mid-November.

20% of analysts are inclined to believe that, in the event of a favorable news background, the positive dynamics of the last months will continue, and Bitcoin quotes will reach the height of $7,400. As for the remaining 20%, they look at the situation more pessimistically, expecting the pair to return to the $5,570-5,850 zone.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited. Trading in financial markets is risky and can lead to a complete loss of deposited funds.

Voltar Voltar