First, a review of last week’s events:

- EUR/USD. Many traders complain of low volatility in the market. But even despite the pessimism of Mario Draghi shown by him after the ECB meeting on Wednesday 10 April, the euro managed to win back about 100 pips from the dollar over the past week and return to the very strong support/resistance zone of 1.1300, around which the pair started moving back in January 2015. The reason for this is most likely the delay in Brexit.

As a result, the forecast which was given by 40% of analysts, supported by 20% of oscillators signaling that the pair was oversold, turned out to be correct. According to them, having pushed off support in the 1.1200 zone, the pair had to go up to resistance 1.1255 and, in case of a breakthrough, reach the height of 1.1300. And this actually happened; - GBP/USD. The overwhelming majority of analysts (65%) expected the strengthening of the British currency. Their forecast was based on the fact that an extraordinary meeting of the European Council would support a long extension of the Brexit procedure, and that the UK would not withdraw from the EU without a deal on April 12. That is exactly what happened. The British Parliament passed a law prohibiting a no-deal withdrawal, and the European Council delayed Brexit for up to six months. They would have given a longer delay if it were not for Macron, the president of France, who cannot wait to take the second place in the EU, after Germany, after the departure of the islanders.

Graphical analysis on D 1 indicated a level of 1.3120 as the main resistance zone, which the pair reached on Tuesday, April 9, but failed to overcome it after 3 attempts. And in the end it finished the week at 1.3070; - USD/JPY. 85% of the experts were confident that the pair would necessarily test the upper limit of the medium-term channel 109.70-112.15. And on Friday, April 12, it almost reached the target, rising to the height of 112.09. However, before that, the pair dropped to the center line of this channel and, only pushing away from it, showed an impressive rise of 115 points. Such a rise of the pair and the strengthening of the dollar against the yen were caused, according to analysts, primarily by the increase in the yield of long-term US bonds in the last two working days of the week;

- Cryptocurrencies. The forecast for Bitcoin was justified by almost 100%. According to 70% of analysts, the main fluctuations of the BTC/USD pair were to occur in the range of $5,000-5,500, where it moved most of the time. Experts also expected bears to try to lower the pair below $4,800, however, all of the attempts were unsuccessful, and the local bottom was fixed at $4,930. As a result, the reference cryptocurrency completed the weekly cycle almost at the same place where it began, in the $5,100 zone.

It should be noted that $5,100 is exactly the height to which Bitcoin unexpectedly took off on Tuesday, April 2. According to the basic version, that price spike was caused by just one investor, who left bids for the purchase of BTC for $100 million on three major exchanges, Coinbase, Kraken and Bitstamp. And the fact that the bull trend has not found its development testifies in favor of this particular version, since a one-time purchase, even for $100 million, cannot be a sufficient reason to start a steady growth of the market.

And if Bitcoin, as well as Ethereum (ETH/USD), kept in the side corridor, the quotes of Ripple (XRP/USD), Litecoin (LTC/USD), EOS and some other top altcoins went into minus. Just on Thursday, April 11, they sank an average of 10%.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

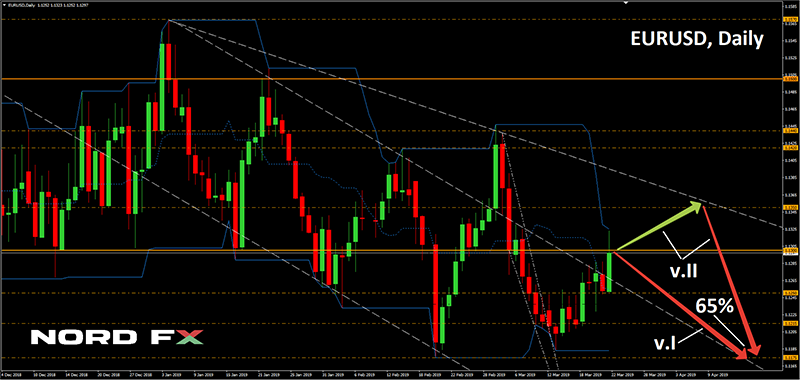

- EUR/USD. If 60% of the trend indicators on D1 are still painted green, the oscillators show a completely different picture: a third of them have acquired a neutral gray color, and another third already signals the pair is overbought. 65% of experts also expect that if not immediately, then by the end of the month, the pair will go down, trying to test again, first the April 2 low - 1.1183, and then the March 07 low, 1.1175. The nearest support is 1.1250;

At the same time, graphical analysis on H4 suggests that before heading south, the pair may rise for a while above the level of 1.1300, reaching the height of 1.1350. The next target of the bulls is 1.1420;

- GBP/USD. Experts believe that the euphoria caused by the Brexit delay will quickly subside, and the pair will stay in a side trend for some time, moving within 1.2985-1.3150. The nearest support is 1.3050, the resistance is 1.3120. However, in the transition to the medium-term forecast, it is already 60% of analysts who have sided with the bulls, expecting the strengthening of the British pound and the pair’s transition to the 1.3200 -1.3350 zone. But the accuracy of this forecast again depends on what will happen around Brexit. There remains a risk of a second referendum, which may entail both a refusal of Brexit in general and, conversely, a British exit from the EU without an agreement. Any news and rumors on this subject can quickly turn the trend in one direction or another, but for now the demand for British currency remains very weak;

- USD/JPY. The bull scenario remains a priority: 70% of the experts, supported by 100% of the trend indicators, look to the north. According to them, if the yield on 10-year US Treasury bonds continues to grow, the pair, relying on support around 112.00, can rise to the area of 113.00-114.20.

However, since at the moment the pair is in the reversal zone near the upper boundary of the medium-term channel 109.70-112.15, a downward rebound of the pair is not excluded, as evidenced by signals from 25% of oscillators indicating it is overbought. Support levels are 110.85, 110.35 and the lower boundary of the channel is 109.70. USD/JPY quotes can also be affected by US-Japanese trade negotiations at the beginning of the upcoming week; - Among other events to which attention should be paid are the following publications: data on the UK labor market and the index of business sentiment ZEW (Germany) on Tuesday, April 16; China's GDP, the UK Consumer Price Index and the Eurozone Inflation Report on Wednesday April 17; UK and US retail sales data on Thursday, April 18; and finally, Japan's consumer price index on Friday, April 19;

- Cryptocurrencies. In general, the news background around the main cryptocurrency is quite positive. The Bitcoin network has overcome another milestone. Over the entire history of the first cryptocurrency, its blockchain has processed more than 400 million transactions. At the moment, the network processes about 350 thousand transfers per day or 14.9 thousand per hour. Approximately 81.5 thousand BTC moves every 60 minutes, and the average transaction size is 5.44 BTC.

Financial analyst and co-founder of Fundstrat Global Advisors Tom Lee said optimistically in an interview with Bloomberg that Bitcoin is back in a bullish trend and the fair price for it today is $14,000. However, not everyone shares his attitude. For example, Brian Armstrong, the head of Coinbase Exchange, believes that the mass influx of investors into the crypto sphere will begin only after three main tasks related to digital assets have been solved. This is the scalability, usability and Bitcoin volatility.

If we talk about a medium-term forecast, the majority of analysts (70%) believe that the BTC/USD pair will necessarily reach $6,000. However, in the coming days, it is likely to move in the range of $4,935-5,335, making attempts to break through these boundaries in one direction or another. So, considering emissions, the range of fluctuations can be expanded to $4,600-5,500.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

Voltar Voltar