First, a review of last week’s events:

- EUR/USD. The vast majority of analysts (75%), supported by 100% of trend indicators and 90% of oscillators, said last week that if the pair overcomes the support level of 1.1200, it will be able to continue moving down. The closest goal is the low of 2018-19, recorded on March 7, 1.1175. At the same time, graphical analysis on D1 stated that the pair would not be able to overcome this support and would return to the horizon 1.1340.

This is what in fact happened. True, the amplitude of oscillations was less than expected: the weekly low was fixed at 1.1183, and the high at 1.1254. As a result, the pair demonstrated the classic sideways trend. Traders even ignored the positive US dollar report on the US labor market, released on Friday, April 5, and the pair completed the working week at 1.1215; - GBP/USD. The behavior of the pair is still dependent on the news of developing political and economic operation called Brexit. News from the “battlefield” - from the Parliament of Great Britain - initially pushed the pound up, since Teresa May promised to hold successful negotiations with the opposition leaders. Investors began to actively buy pounds, and, as predicted by graphical analysis, it quickly reached the center of the five-week side corridor 1.2960-1.3350 at the level of 1.3150.

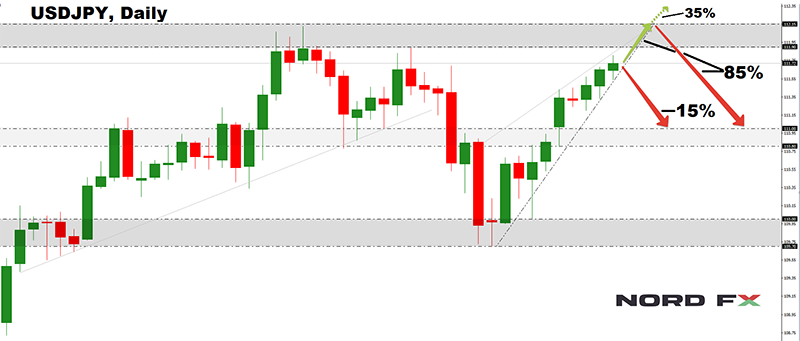

But the first round of negotiations ended in failure, and investment funds began to close positions on the pound. At the same time, the negative background was supplemented by the news from the European Parliament, which mockingly rubs its hands, watching the rift of the British colleagues. As a result, the trend for this pair changed every two days and, having experienced a series of ups and downs, it put the final point almost at the same place as a week ago, at around 1.3035; - USD/JPY. Recall that at the beginning of the week the pair was practically in the center of the channel 109.70-112.15. And the question was whether it would go down or up. Although only 35% of the experts voted for its growth, declarations of Donald Trump on the successful course of the US and China trade negotiations, and the growth of the US stock market moved the pair up. Having reached a high at 111.80 on Friday, April 5, after a small pullback, the pair completed the five-day week 10 points lower;

- Cryptocurrencies. Our forecast last week said that the bitcoin would be able to overcome the resistance of $4,200 and gain a foothold in the range of $4,200-4,280. But on Tuesday, April 2, the reference cryptocurrency made an unexpected jump and, soaring by 14.4%, broke the bar of $5,000. This movement was the strongest jump since the boom of the end of 2017.

Traders are wondering what is behind this surge, a variety of versions has been expressed. The version voiced by Oliver von Landsberg-Sadie, the head of the BCB Group, in an interview with Reuters, seems most likely. He said that the bitcoin price jump was caused by just one investor, who distributed bids for the purchase of BTC for $100 million on three major exchanges - Coinbase, Kraken and Bitstamp. The total volume of transactions then amounted to about 20.000 BTC, and the total capitalization of the crypto market exceeded $170 billion.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. On Wednesday, April 10, we are waiting for the next ECB interest rate decision. Most likely, it will remain unchanged. But it became known that the European regulator is actively discussing options for more aggressive stimulation of the economy. This can be either a reduction in rates or an increase in the QE quantitative easing program. This news contributes to the growth of investor interest in shares of European companies and to a fall in interest in the European currency. Also, on Wednesday the meeting of the US Federal Reserve Committee minutes will be published, which should shed light on the further monetary policy of the American regulator.

For the nearest future, the strongest factor putting pressure on the euro, of course, is the tiresome mess with Brexit. Perhaps that is why 60% of the experts, supported by 100% of the indicators and 80% of the oscillators on D1, have voted for a further decline of the pair. The immediate goal is the low of 07 March 2019, 1.1175, the next support was recorded in the summer of 2017. and is located 60 points lower.

40% of analysts preferred the bulls. Moreover, it is already 20% of oscillators on D1 that give signals the pair is oversold. In their opinion, having pushed off support in the 1.1200 zone, the pair will go up to resistance 1.1255 and, in case of a breakthrough, move to the height of 1.1300. The next resistance is 1.1345. - GBP/USD. Interestingly, if most experts believe that Brexit will continue to have a negative impact on the euro, the opinion on the pound is opposite. 65% of analysts expect the upcoming week to strengthen the British currency. Their forecast is based on the fact that the extraordinary meeting of the European Council on April 10 will support the extension of the Brexit procedure for a long time and that the UK’s withdrawal from the EU without a deal on April 12 will not take place. the graphical analysis on D1 is also in solidarity with such a forecast, indicating that the pair is growing, first to the zone of 1.3120, and then to resistances of 1.3200 and 1.3265.

A fall of the pair is expected by 35% of analysts and 90% of indicators. At the same time, 10% of oscillators are already signaling that the pair is oversold, which indicates the traders' doubts about the future of this pair. Support levels are 1.2975, 1.2900 and 1.2830; - USD/JPY. Over the past two weeks, the pair has gone from the bottom of the medium-term channel 109.70-112.15 almost to its upper limit, ending the week at 111.70. And 85% of experts are sure that it will definitely test the resistance of 112.15. But those who believe that the pair will be able to rise even higher and reach the level of 113.00, are only 35%. So, the probability that the pair will not go beyond the upper limit of this channel is large enough. 25% of oscillators on D1, which are already in the overbought zone, agree with this. The basic support is Pivot Point of the channel 110.80;

- Cryptocurrencies. An unexpected bitcoin jump spawned a whole wave of all sorts of events and rumors. Thus, the mysterious creator of Bitcoin Satoshi Nakamoto has reappeared from oblivion. He has re-activated a Bitcointalk account that has been inactive for many years. Over the past 10 years, the identity of Satoshi has not been disclosed, although there are various assumptions about who may be hiding under this mask. Thus, a group of hackers who have hacked several large crypto-exchanges, believes that he is American entrepreneur, inventor and engineer Ilon Musk. In their opinion, the largest transactions with cryptocurrencies (possibly the last one for $100 million as well) were carried out from the Bel Air neighborhood in Los Angeles. And it is there that the legendary founder of SpaceX and Tesla has been living for many years.

As for the forecast, 70% of analysts believe that the main fluctuations of the BTC/USD pair in the coming week will occur in the range of $5,000-5,500. However, the remaining 30% are confident that a one-time purchase of bitcoins by one investor, even for $100 million, is not a sufficient reason to start a steady bull trend. And so the pair has a lot of chances to go below $4,800 horizon. In this case, the main level of resistance is the $5,100 horizon.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited. Trading in financial markets is risky and can lead to a complete loss of deposited funds.

Voltar Voltar