First, a review of last week’s events:

- EUR/USD. If you look at the chart of the pair, it is clear that by the evening of Friday, November 23, it returned to the values of Friday morning, November 16. That is, the result of the week is close to zero, and the victory for the most accurate forecast can be awarded to trend indicators and oscillators on D1, which had taken a neutral position.

As for the experts, a third of them had predicted the continuation of the pair’s correction up to the level of 1.1450-1.1550 (actual maximum of the week is 1.1470), with the subsequent return of the dollar to growth. This actually did happen, as a result, the pair ended the week at 1.1330; - GBP/USD. The result of last week for this pair is similar to the result of EUR/USD, that is, close to zero. On Thursday, when it became known that the European Commission had approved the political declaration on Brexit, it seemed that the pound had a chance to reverse the negative situation. It soared 150 points to the height of 1.2925. But the joy of the British currency holders was short-lived, and the pair met the end of the five-day period in the 1.2810 zone;

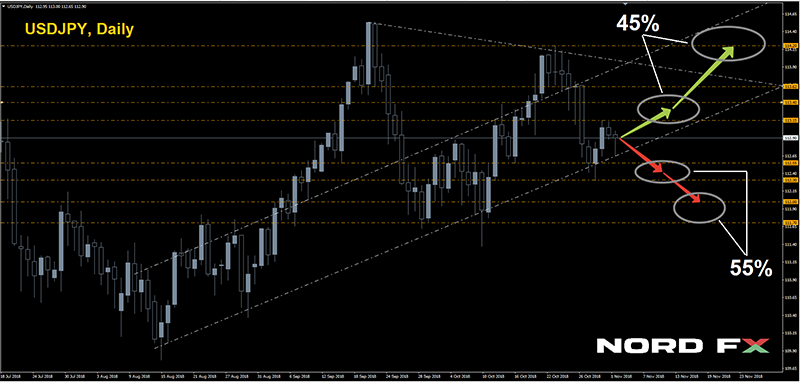

- USD/JPY. Regarding the future of this pair, the opinions of experts had been divided almost equally: 45% had voted for the pair to fall, 45% had voted for its growth, and 10% had taken a neutral position. And they all turned out to be right: the pair was falling in the first half of the week, then it was growing, and it showed a zero result by the end of the session, returning to Pivot Point in the 112.90 zone. As for the support/resistance levels, graphical analysis was most accurate here: it marked the upper limit of the channel at 113.10 on H4 (the pair rose to 113.14), and a fall to 112.65 on D1 (the weekly minimum was fixed at 112.30);

- As for cryptocurrencies, there were two versions of the forecast, a neutral one and ... a very bad one. Naturally, the second one came true. Panic moods from the hard forks (division) of BCH (Bitcoin Cash) to two new coins continued to put pressure on the market. As a result, the bitcoin flew further down, reaching the values of September last year in the $4,210-4,250 zone, and pulled other cryptocurrencies with it: the TOP-5 index lost more than 500 points, or about 25% during the week.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. The most important event that can seriously affect the quotes of both the euro, and the British pound, will be the extraordinary Summit of European leaders on Brexit, which will be held on November 25-26. In case its results are positive, the pair may return to November highs of 1.1470 and 1.1500. However, less than half of the experts agree with this scenario, 40%.

As for the remaining 60%, they continue to insist the dollar will strengthen. On Wednesday, November 28, the market is expecting data on the US GDP for the 3rd quarter, and if they turn out to be better than in the 2nd quarter, this will give the American currency a strong support. You should also pay attention to the minutes of the US Federal Reserve meeting on Thursday, November 29, although no special surprises are expected from it.

The targets for the bears are 1.1300 and the 2018 low of 1.1215, in the case of a breakdown of which the path to support 1.1120 is opened.

If we talk about indicators, about 15% of the oscillators on H4 indicate that the pair is oversold, which may portend a short-term correction; - GBP/USD. Almost 100% of the indicators are painted red. But future trends are not determined by them at all. The decisions of the EU Brexit Summit are, of course, very important for the pound. But it faces an even more serious test: the deal on the terms for the British exit from the European Union has yet to be approved by the British Parliament. And there are many chances that the parliamentarians will vote against the deal. In this case, a second vote will be required, which may be scheduled for February, and up to this point investors will be wary of the pound.

In the meantime, expert opinions are equally divided: half of them are for the growth of the pair, half are for its fall. The nearest support levels are 1.2720 1.2695, 1.2660, the resistance levels are 1.2885, 1.2925 and 1.3025; - USD/JPY. The Japanese currency often goes counter-trend to its European counterparts: when the euro and the pound fall against the dollar, the yen rises. It is this perspective that is drawn by analysts for the next week. 55% of them, supported by 90% of oscillators and 70% of trend indicators, vote for the fall of the pair first to support 112.60, and then 30 points lower. It is possible that the pair will be able to successfully test the level of 112.00.

The alternative scenario is supported by 45% of experts, graphical analysis on D1 and 10% of oscillators, signaling the pair is oversold. The targets of the bulls are zones 113.15-113.40 and 114.20-114.55.

- Cryptocurrencies. Most likely, the negative trend in the market will continue, and the bitcoin will try to break through the level of $4,000. The next target is 1,000 points lower. Another vulnerability was found in smart contracts based on ethereum, and the ETH/USD pair may fall to the most important psychological level of $100. The target for the litecoin (LTC/USD) is to consolidate below $30, and for the ripple (XRP/USD) - below $0.40.

As for the good news for crypto bulls, there is divergence between the quotes of Bitcoin and the readings of many oscillators, which indicates a possible upward correction. However, according to most experts, this correction will be short-term.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

Voltar Voltar