First, a review of last week’s events:

- EUR/USD. As expected, the week was full of multidirectional economic news, which caused first growth, and then the fall of this pair. Recall that 45% of experts, relying on the problems in the US-Chinese negotiations and the contradictions between the US president and the head of the Fed, predicted a further weakening of the dollar and the growth of the pair to the height of 1.1750. As a result, the pair reached the high at 1.1735.

Weak statistics from the eurozone supported those 35% of analysts who had talked about strengthening the dollar. As a result, those 25% of experts proved to be completely right, who could not decide on the direction of the main trend, because, after the week's fluctuations, the pair eventually returned to the values of a week ago and completed the five-day period at 1.1600.

If we look at the charts D1 and W1, it is clear that after the August peak and fall to 1.1300 the pair has once again entered the side channel 1.1575-1.1750, where it moved all mid-summer; - GBP/USD. Problems related to Brexit continue to scare off foreign investors. The data published on Thursday August 30 indicate that they continue to actively get rid of British assets. The sale off of government bonds has reached its peak since 1982. - £ 17.2 billion. Despite this, the pound managed not only to hold positions, but even to win back about 200 points against the dollar after the EU negotiator Michel Barnier announced on Wednesday that he was ready to make the Brits a unique trade proposal. However, Mr. Barnier played back a little later, saying that he did not rule out the hard version of Brexit, as a result of which the pair met the end of the week session at the level of 1.2960;

- USD/JPY. Recall that most experts (65%) predicted the growth of the pair, indicating a target level of 112.00. The fact that the pair is overbought which was signaled by 20% of the oscillators, could limit this growth and turn the trend around. The level 110.75 was called as the nearest support.

In reality, the pair rose to the height of 111.82, and then fell to the horizon of 110.70, so these goals can be considered fairly accurate. The final chord was set in the zone 111.10, which can be considered Pivot Point of the last six weeks; - Cryptocurrencies. The crypto market has successfully survived the information that the US Securities and Exchange Commission (SEC) rejected another batch of applications for the launch of bitcoin-funded investment funds (bitcoin-ETF). There was more optimism thanks to the hope for the revision of these applications, as well as the information that Yahoo Finance has acquired an opportunity to carry out trade operations with bitcoin, Litecoin and Ethereum.

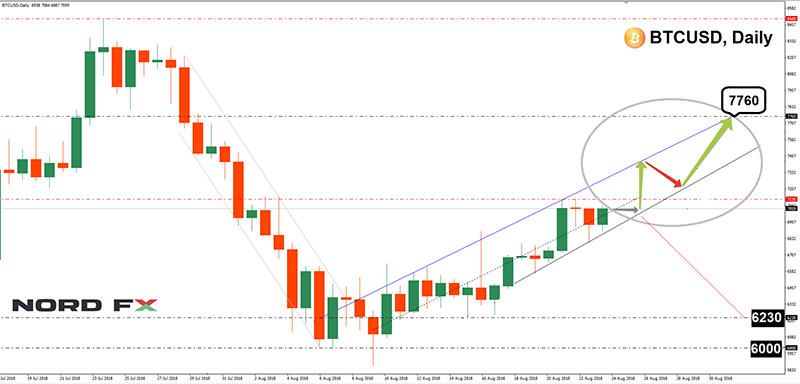

The experts called the taking of the height of $ 6,850, and then $ 7,760 as bulls' targets for the pair BTC/USD. Backed by the positive news, the pair easily broke through the resistance of $6,850, but the strength of the bulls dried up at the height of $7,130 and it returned to the resistance zone, turning it into a support zone. However, the pair was able to rise again above $7,000 by the end of the week.

As for the major altcoins, their graphs repeated the dynamics of the main crypto currency, but it was only Litecoin (LTH) that managed to fix a small growth, adding about 9%. But Ethereum (ETH) and Ripple (XRP), after growing in the middle of the week, returned to their original values.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. The main trends for the upcoming week can be defined as follows: the small growth of the pair in its first half and the fall towards the end of the five-day period.

15% of oscillators on H4 indicate the pair is oversold. In addition, the market expects negative data on business activity in the US on Tuesday, September 04, which may weaken the dollar and allow the pair to rise to the 1.1700-1.1750 zone. The next resistance is at 1.1800.

However, most experts (60%) expect the dollar to strengthen. This should be facilitated by the release of a series of data on the labor market, including data from ADP on Thursday and NFP indicators on Friday, which are expected to become a strong support for the dollar and may bring the pair closer to the mid-August low in zone 1.1300. The nearest support is in the zone 1.1500-1.1525. The graphical analysis on H4 and D1 also agrees with this development.

It should be noted that in the medium term, the positive dynamics of GDP growth and a strong labor market are quite powerful factors for tightening the monetary policy of the Fed and, as a consequence, of the further strengthening of the US currency; - GBP/USD. Most analysts (60%) are looking north. They remember both the unique proposal of Michel Barnier and the fact that the index of business activity in the service sector of Great Britain can show a significant increase in August, from 53.5 to 54.7, which will become a serious bullish stimulus for the sterling. As a result, the correction may continue, and the pair will rise to the zone 1.3140-1.3170. More than 80% of oscillators on D1 are painted green as well.

An alternative view is expressed by graphical analysis on D1 and 40% of experts, who are confident that Brexit problems will outweigh any positive economic data. This is the reason that the pair will soon return to the downtrend. The nearest support in the zone 1.2800, the main target is 1.2660; - USD/JPY. Graphical analysis on D1 draws a motion in the lateral channel with a rather narrow range 110.00-111.4 5. More than 55% of experts and oscillators agree with this scenario, the oscillators are approximately equally colored in green, red and neutral gray colors. The reasons for such a forecast are the same. They are on the one hand, low inflation, which hinders Japan's GDP growth, and the success of the US economy, as well as, on the other hand, the role of the yen as a safe haven in the US-China wars and scandals related to the election of US President Donald Trump.

In case the pair goes out of the above corridor, the following support is located at 109.30 and 108.65, and the resistance is 112.15 and 113.15; - Cryptocurrencies. The bearish targets for the BTC/USD pair are still the same: the breakdown of support $6,230, then $6,000 and a descent to a low of $5,760. However, if nothing extraordinary happens, the decline below the mining profitability level in the $6,000-6,230 zone seems almost impossible now.

From the point of view of most experts, the growth of the pair is more likely to reach $7.760, then correction, and a new jump upwards, now to the high of July 25, $8.500.

Roman Butko, NordFX

Voltar Voltar