Traditionally, summer is the time when business activity slows down: VIPs are basking in the sun on their snow-white yachts, the heads of the Central Banks leave the boring offices, setting important tasks aside for the autumn, and they are followed by ordinary traders who get a break. However, even the summer months can present surprises. Suffice it to recall the referendum on the withdrawal of the UK from the EU in June 2016, the results of which literally shocked all the stock and financial markets.

Such breaking news is not expected in the coming three months, but some events will be able to exert a strong, if not decisive, influence on the formation of exchange rates and trends.

- EUR/USD. Most likely, the ECB will send a signal in summer about its intention to end this year with a super-soft policy of buying up assets. This will happen, most likely, either after the meeting on June 14, or July 26, because the next meeting will happen in autumn. The intention to finish with the quantitative easing program (QE) and go into a new phase of development has been repeatedly stated by the heads of European Central Banks - by the head of the Bank of France Villeroia de Gallo, and the management of the German Bundesbank, and the head of the Bank of Lithuania Vitas Vasiliauskas.

As a result, despite the fact that the Euro can still continue to decline for some time, the markets are already prepared for a trend change. And if after one of the mentioned meetings the statements of the ECB Head Mario Draghi contain hawk notes, the Euro will immediately fly up.

More than 60% of the polled experts agree with this scenario at the moment, they believe that the pair EUR/USD will definitely return to the highs of 2018 in the zone 1.2400-1.2555 by September.

10% of analysts are still undecided, and about 30% of experts have voted for the further strengthening of the dollar. This, in their view, will be facilitated by the further raise of the interest rate by the US Federal Reserve against the backdrop of the ECB's muffled rhetoric. The bears' supporters expect the Fed to raise the rate by another 0.5% in the next six months, which will lead to a fall of the euro to the last September's low in the zone 1.1550. Moreover, such a decrease may occur in the near future, far outstripping the real actions of the Fed.

If we talk about technical analysis, its forecasts are more modest. It predicts a fairly low volatility and fluctuations of the pair in the corridor 1.1600-1.2000 for the beginning of the summer. Oscillators also expect correction upwards after 700 points of fall. So, a quarter of them are already signaling that this pair is oversold on the daily and weekly timeframes. - GBP/USD. The pound continues to be pressured by uncertainty and disagreement with the European Union regarding the Brexit, as well as the absence of any changes in the monetary policy of the Bank of England. Starting from April 17, the pound has already lost more than 900 points and, if you look at the readings of graphical analysis and indicators, it does not intend to stop there.

So, the graphical analysis on D1 assumes that, having beaten off from resistance 1.3455, the pair can sharply go down, reaching the bottom at the level of 1.3065. And in case of the breakdown of this support, it can fall another 300 points lower - to the horizon 1.2765.

However, only 35% of experts support this development, 10% are neutral and 55% are confident that, starting from the middle of summer, the pound will start to gain strength and the pair will rise at least to 1.4000-1.4100. In this case, we must take into account that as of now, only one out of ten oscillators indicates that the pair is oversold. - USD/JPY. It is clear that almost all trend indicators and oscillators on D1 and W1 are painted green. Only 10% of oscillators say that this pair is overbought.

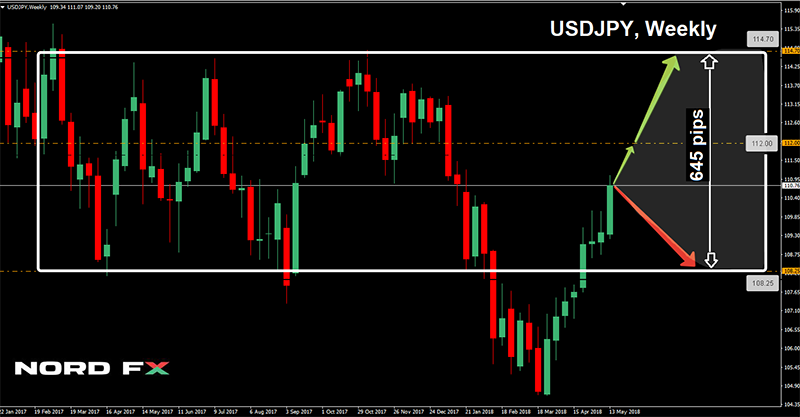

It is necessary to pay attention to the fact that the pair has returned to the boundaries of the side channel 108.25-114.70, along which it has moved starting from the beginning of 2017. It broke through the lower boundary of this corridor in mid-February 2018, but now it has again approached its Pivot Point. Perhaps this is the reason for the divergence of opinions among experts: a third of them are for the movement of the pair to the north, a third vote for the east and a third think it will go to the south.

We can conclude from the above that the pair will stay in this range for the nearest months, which is confirmed by graphical analysis. At the beginning of summer, it expects the pair to move in the range of 108.25-112.00, after which the pair can go up to resistance 114.70.

- Cryptocurrencies. We should remind you once again that, due to the fact that the cryptocurrency market is thin and has increased volatility, digital currency rates can be strongly influenced not only by the decisions of various regulators, but also by the statements and actions of private companies and newsmakers of this industry.

For the pair BTC/USD, experts expect growth to the height of 11,750-12,980 by the middle of July, after which it is expected to roll back - first to the horizon of 10,000, and then, possibly, to the support of 7,160.

Analysts expect about the same dynamics for other cryptocurrencies included in the TOP-10 in terms of capitalization. So, it is not excluded that the pair ETH/USD will overcome the mark of $1000 for 1 coin in July, then it will return to the values of May in the $650 area.

LTC/USD. The pair will try to approach the height of $200 for a litecoin, then it will roll back to $140.

The immediate goal of the pair XRP/USD is to return to zone 0.8850. If it is reached, the next height is 1.0000, after which the rollback to the values in the region of 0.6300-0.7000 is expected.

Roman Butko, NordFX

Voltar Voltar