First, a review of last week’s forecast:

- EUR/USD. Recall that about 70% of experts expected that the pair would rise at least to the height of 1.2050. However, the bulls' strength dried up before it approached the level of 1.2000, where the initiative was intercepted by the bears. Trend indicators on D1 and 15% of the oscillators sided with them, giving signals that the pair was overbought. As expected, the pair was quick to reach the horizon 1.1800, and then moved further down, having touched the local bottom at the level of 1.1750;

- GBP/USD. This pair moves in a fairly narrow side corridor for the second week in a row. Most analysts (60%) voted for its growth last week. But, having gone 65 points to the north, the pair turned around and, as was expected by the remaining 40% of experts, dropped to the support of 1.3450, near which it met the end of the session, having lost only 75 points during the week;

- 70% of experts predicted that the pair USD/JPY would rise to 110.00 by the end of May. But it was much ahead of expectations, having reached this level of resistance already on Tuesday, May 15. After that, turning it into a support, the pair went another 100 points higher. Then it lost 25 points and finished the five-day period at the level of 110.75;

- Cryptocurrencies. Some analysts believed that the BTC/USD pair should return to the borders of the three-week side corridor 8,620-9,955, and on May 14 it reached the level of 8,850. However, it didn't manage to gain a foothold at this level, and soon the pair retreated to the values of the beginning of the week in the zone 8,000. In general, the week was quite calm for other major cryptopairs: the Litecoin as well as the Ethereum and the Ripple completed it almost in the same place where they started.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

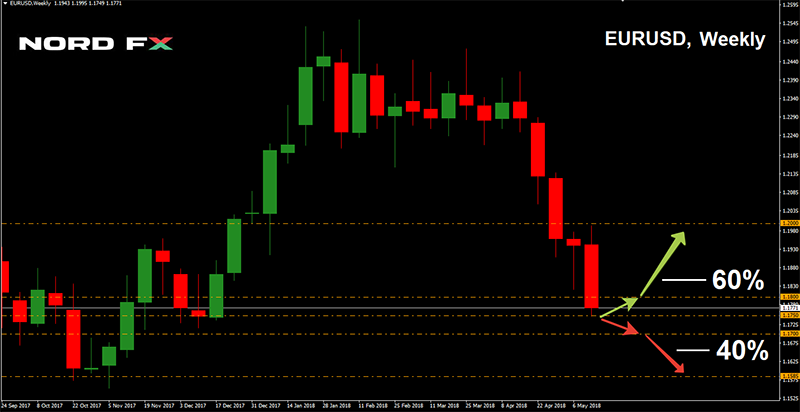

- EUR/USD. 60% of experts predict the movement of the pair to the east along Pivot Point 1.1800. Graphical analysis on D1 also draws a side channel, indicating the boundaries as 1.1750-1.2000. 15% of the oscillators also indicate a certain growth of the pair, giving signals that it is oversold.

The remaining 40% of analysts expect the continuation of the downtrend. Support is at the levels of 1.1700, 1.1665 and 1.1585.

Talking about important events of the upcoming week, we should pay attention to the meeting of the FRS Committee on Open Markets on Wednesday, May 23, the ECB meeting on monetary policy on Thursday, May 24 and the speech of the head of the US Federal Reserve, J. Powell, on Friday, May 25.

- GBP/USD. The experts' opinions are divided almost equally: 35% are for the growth of the pair, 35% are for its fall and 30% vote for the continuation of the lateral trend.

As for graphical analysis, it also predicts lateral movement in the range 1.3450-1.3615 on both H4 and D1, after which a powerful collapse and the transition of the pair to 1.3300 zone is expected to follow. - USD/JPY. 65% of experts, 95% of trend indicators and 90% of oscillators, as well as graphical analysis on D1 expect the continuation of the uptrend. The nearest goal is the height of 112.00, the next one is 100 points higher.

35% of analysts have voted for a decline, supported by 10% of the oscillators, which signal that the pair is overbought. Graphical analysis on H4 does not exclude the possibility of temporary correction down to the horizon of 109.85; - Cryptocurrencies. The main forecast of stock exchange experts on the BTC/USD pair assumes the growth of bitcoin in an effort to reach $10,000. Support is at the levels of 8,100 and 7,900.

As for the oscillators, there is no unity among them. For example, MACD on H4 demonstrates a small divergence with a price chart, which indicates the possibility of the growth of the pair. On the other hand, the indicator of trading volumes MFI (Money Flow Index) on H4 is in the overbought zone and looks to the south. On D1, the picture is exactly the opposite.

As for other cryptopairs, analysts believe that their correction is completed, and now they will strive up, following the bitcoin. Ethereum (ETH/USD): the nearest target is 740.00, the next one is 835.00, the support is 635.00. Litecoin (LTC/USD): the goals are 150.00 and 180.00, the support is in the area of 130.00. Ripple (XRP/USD): the target is 0.8850, the main support is 0.6140.

Roman Butko, NordFX

Voltar Voltar