First, a review of last week’s forecast:

- EUR/USD. The publication of positive data on the labor market in the USA (NFP grew by 25%) on February 2, triggered a panic on American stock exchanges. According to experts, the increase in the number of jobs at the same time with an increase in the average wage indicates not the recovery, but the overheating of the world's largest economy.

As for the dollar, unlike the stock indices, in anticipation of higher inflation and higher interest rates, on the contrary, it continued to grow against the euro, as it started on February 2, having strengthened its positions by more than 200 points. This change of trend from bullish to bearish once again confirmed that the medium-term forecast often prevails over the weekly forecast. Recall that in the medium term, 70% of experts voted for the growth of the dollar; - GBP/USD. Just as in the case of EUR/USD, analysts predicted that in the medium term, the dollar would strengthen against the British pound. As for the weekly forecast, 45% of experts expected the fall of the pair. At the same time, they were supported by 30% of oscillators on H4, which is a fairly strong signal that the pair is overbought. The dollar was also supported by the unanimous decision of the Bank of England to keep the interest rate unchanged at 0.5%. As a result, the Briton lost about 285 points during the week and returned to the values of the middle of January;

- giving a forecast for the USD/JPY, the majority of experts (55%), supported by graphical analysis on H4 and D1, as well as half of trend indicators and oscillators on D1, was confident that the pair would again test the lower level of the mid-term side corridor 108.00-114.75. The pair indeed approached the 108.00 mark twice, however, before reaching any 45-50 points, it retreated, and as a result it completed the five-day period in the zone 108.75;

- USD/CHF. Here, almost 70% of the experts, in full agreement with the graphical analysis on H4 and a quarter of the indicators, expected the pair to go up. The closest target was called the level of 0.9575. The pair did, starting Monday, go north and, having passed 135 points, reached the height of 0.9470 on Thursday. However, there the strength of the bulls dried up. As a result, it met the end of the week's session at 0.9395.

It is difficult and ungrateful to give a forecast in the conditions of panic in the stock markets, but we will still try to summarize the opinions of analysts representing a number of banks and broker companies, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis.

- EUR/USD. It is clear that, after the last week's fall, most of the trend indicators and oscillators look to the south. 55% of experts who were expecting the pair to go down to the zone of 1.2000 are also looking there.

45% of analysts have an alternative point of view, as well as 35% of trend indicators on D1 and a quarter of the oscillators which give signals that the pair is oversold. According to this forecast, the pair should return to zone 1.2350-1.2530.

As for the graphical analysis on D1, it expects that before the pair can go up, it may fall back to support 1.2165. The decline looks deeper on H4, down to the level of 1.2080; - GBP/USD. In this case, the experts' opinion, the indications of trend indicators, oscillators and graphical analysis, with only small differences, repeat what was said about the EUR/USD. Experts: 55% are for the fall of the pair, 45% are for the growth. Graphical analysis: possible decrease to the zone 1.3585-1.3660, then return to January highs - 1.4150-1.4350. The nearest resistance is 1.3985. Oscillators: about 15% claim that the pair is oversold, the rest are painted red;

- USD/JPY. Most (60%) experts expect that the pair will still reach the lower boundary of the medium-term side corridor 108.00. Moreover, as the graphical analysis suggests, it can even fall to the September 2017 low - the 107.30 mark, after which it is expected to rebound and return to the middle zone of the corridor 110.30-111.75. As for the rest of the analysts, in their opinion, the pair will go up from the very beginning of the week in order to reach the height of 110.00.

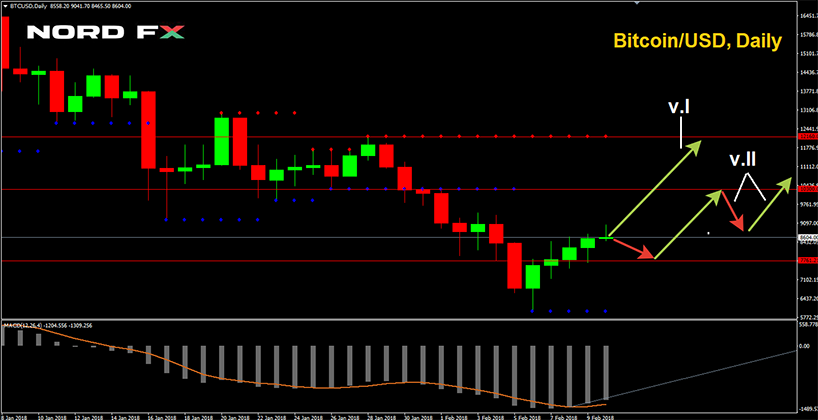

- And, at the end of the review, for the first time, we will try to give a weekly forecast for the main cryptocurrency pairs, basing on the opinions of crypto-exchanges experts In this case it is necessary to take into account that these pairs are extremely exposed to external factors, and each piece of news or event can cause not only significant fluctuations, but also a reversal of the trend. So:

Bitcoin (BTC/USD) - growth to the area of 10,300-12,160;

Ethereum (ETH/USD) - growth to the area of 1,025-1,125;

Litecoin (LTC / USD) - growth to the area of 173-213;

Ripple (XRP/USD) - growth to the area of 1.015-1.185.

Dear traders, broker company NordFX offers you the opportunity to trade crypto currency with a unique leverage of 1:1000.

Deposits in USD and Bitcoins.

https://nordfx.com/promo/tradecrypto.html

Roman Butko, NordFX

Voltar Voltar